Equinix (

EQIX) recently released a few additional data about

the proposed acquisition of Switch and Data (SDXC), which are worth a mention.

Stephen Smith, CEO, and Keith Taylor, CFO, participated at the NASDAQ OMX Investor Conference, where they covered a few issues related to the acquisition rationale.

Portions of the transcript of the presentation, held on December 2, 2009, have been filed with the SEC. Slides presented on that occasion are also available on the Equinix I/R section.

Additionally, Equinix filed an S-4 form which gives a great insight into the combination of the two Companies, including some background to it.

We'll start from the NASDAQ OMX Conference, where management summarized several key reasons why Equinix went for this move (web cast available at this link):

- Stephen Smith—Equinix Inc.—President and CEO

- So we announced on October 21 the acquisition of Switch & Data for $689 million of equity value at the time of signing on October 20. It is an 80/20 split. 80% stock, 20% cash. We expect to close this sometime mid to late first quarter.

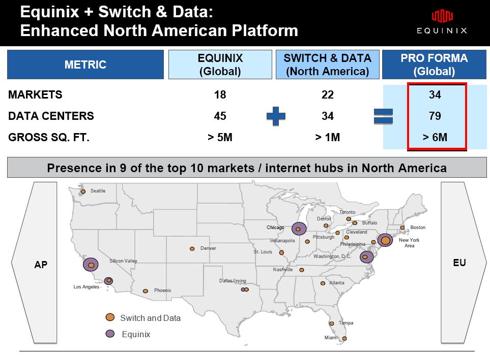

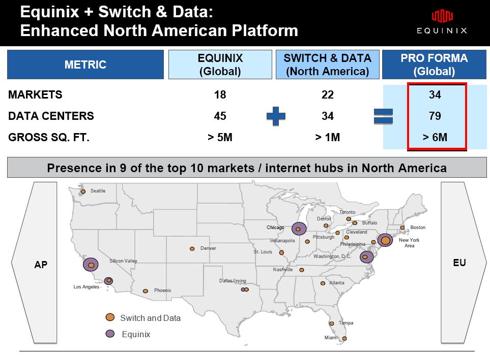

- The rationale for the deal was pretty straightforward. This is a US-based decision. It is driven by scale, access to capital, cost of capital, all the things that are driven underneath a capital-intensive business that are going to bring us into new markets. We were in six markets in the US. We will pick up an additional 16 markets.

- They will bring us capacity in the current six markets that we are in today. The interconnection, they’re are very focused. It is a very similar business model to the Equinix business model. They are very network dense. They are very network focused. So from an integration standpoint this will be fairly straightforward and there are synergies here.

- And then financially, we will pick up some NOLs here so there will be a financial benefit.

- It will now put us in nine of the top 10 markets in the US. And again, that is very important to us as we study the future trends of the business more and more of this infrastructure, servers, storage equipment and networking gear is getting deployed closer to the edge of the network. The edge of the network is extending. Latency matters for the applications are running on this infrastructure.

- So having a broader footprint in the US has been very, very critical for this decision.

- So we are pretty excited about this. This really gives us a chance in the US market to really be able to satisfy almost any requirement that we would see anywhere in the US from a city standpoint.

(you may click on the chart to enlarge)

Two key points from the presentation:

- Stephen Smith—Equinix Inc.—President and CEO

- It is going through the regulatory and Department of Justice review as we speak.

- On the cost side, we’ve estimated $20 million of synergies who keep an eye on the rest of the leadership team, believe that there will also be revenue synergies.

It is pretty standard for acquisitions of this size to go under Department of Justice investigation, as Tier 1 Research summarizes:

- T1R Insight: Equinix acquisition of Switch and Data under DoJ scrutiny

- The US Department of Justice is scrutinizing the proposed acquisition of Switch and Data by Equinix. Many who have seen similarly sized M&A deals are not surprised – this type of examination is fairly standard. T1R has spoken with several Equinix customers that have discussed the connotations of the deal.

Equinix has also recently re-filed a Notification and Report Forms with the Antitrust Division of the Department of Justice:

- Equinix FORM 8-K

- Equinix’s re-filing will give the Antitrust Division staff more time to review the information submitted by the parties and to complete its initial investigation before the staff must determine whether to issue a formal request for additional information. The effect of this re-filing will be to extend the waiting period under the HSR Act an additional 30 days to January 6, 2010.

As to the savings/synergies announced at the conference, the $20 million forecasted do represent a relevant number, if we take into consideration that Switch and Data's revenues are, right now, about $ 215 million per year (3Q 2009 revenues of $53,5 million annualized). There's certainly room to improve leverage in the business, through this acquisition.

The S-4 Form gives a great insight into the acquisition, its background, and some of the future targets for the combined Company (and the sector).

First, a look at the history of the deal:

- Background of the Merger

- Over the years, including prior to Switch and Data’s initial public offering in 2007, its board of directors and management have regularly evaluated its business and operations, as well as its long-term strategic goals and alternatives to maximize stockholder value in light of changing business and market conditions. Switch and Data’s board of directors has regularly examined potential strategic acquisitions or combinations, including a potential business combination with Equinix in 2006. These discussions, however, were terminated prior to Switch and Data’s initial public offering in early 2007, because the expected value of Switch and Data following the initial public offering significantly exceeded the value that Equinix had indicated it would be willing to offer.

- In January 2009, a representative of Switch and Data was approached by a privately-held firm in its industry based outside of the United States (the “International Party”) to explore whether a business combination might be feasible. A non-disclosure agreement was executed on March 17, 2009.

- In late April 2009, prior to Piper Jaffray being engaged as Switch and Data’s financial advisor, an Equinix representative indicated an interest in meeting with Switch and Data during a discussion with a representative of Piper Jaffray. The representative of Piper Jaffray delivered this request to William K. Luby, the chairman of Switch and Data’s board of directors.

- On September 9, 2009, Switch and Data’s board of directors had a telephonic meeting with representatives of Piper Jaffray to discuss the August 28, 2009 letter of intent, the current proposed transaction terms with Equinix and the International Party, the current state of negotiations with Equinix and the International Party and the alternatives available to Switch and Data (which consisted of remaining independent, completing a transaction with Equinix and combining with the International Party). The board of directors asked representatives of Piper Jaffray several questions regarding the valuation range that might be achieved in further negotiations with Equinix and a discussion ensued.

- … on September 25, 2009... the Switch and Data board of directors also determined, based upon the analysis of its financial advisors and after comparing the value to Switch and Data’s stockholders of a transaction with the International Party in which Switch and Data would be the surviving company with the proposed transaction with Equinix, that a transaction with the International Party was unlikely to result in value to Switch and Data’s stockholders equal to or greater than the proposed transaction with Equinix. Also, based upon the Switch and Data board of directors’ knowledge of the industry and the analysis of Switch and Data’s financial advisors, the board determined not to approach the other participants in the industry. This was due to the significant premium offered by Equinix, the knowledge of the strategies and the financial conditions of the participants in the industry and the risk of delay imperiling the proposed Equinix transaction.

The guessing game about the name of the International Party interested in a merger with Switch and Data may begin (as a reminder SDXC had an agreement to jointly market services with Interxion in Europe) - it is obvious that Equinix's move, as we wrote previously, also obtained the result to avoid the creation of a global competitor in the sector, and stopped a foreign entity from achieving a US listing, without going through an IPO, and a strategic footprint in the most important market for the colocation sector.

The most interesting piece of information, however, is hidden among the considerations made by the two Companies through the negotiations that led to the combination of Equinix and Switch and Data.

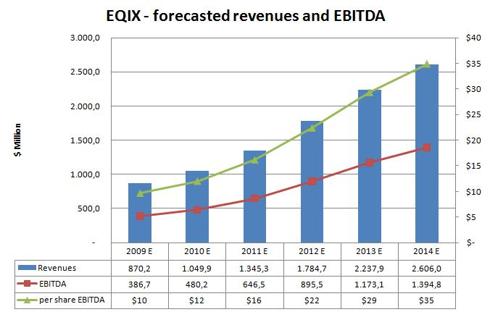

- Equinix Projected Financial Information

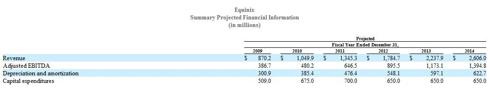

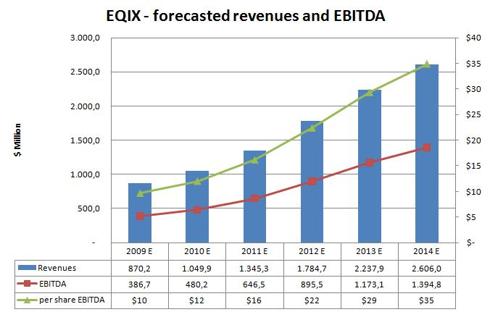

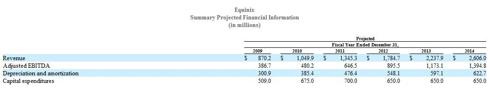

- Equinix does not as a matter of course make public projections as to future performance, earnings or other results beyond the current fiscal quarter due to the unpredictability of the underlying assumptions and estimates. However, in connection with the merger, Equinix provided Switch and Data with non-public projections of Equinix’s standalone financial performance for its fiscal years 2009 through 2014 as set forth below.

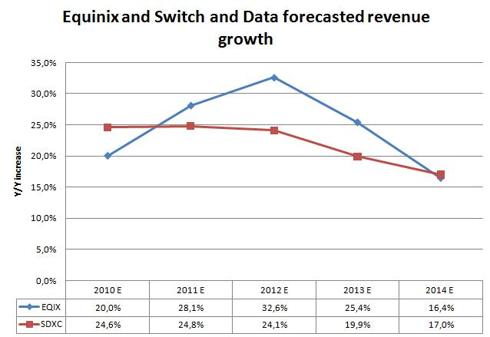

Switch and Data also provided similar projections to Equinix for the same time frame (5 years). Here are the two data sheets (click to enlarge):

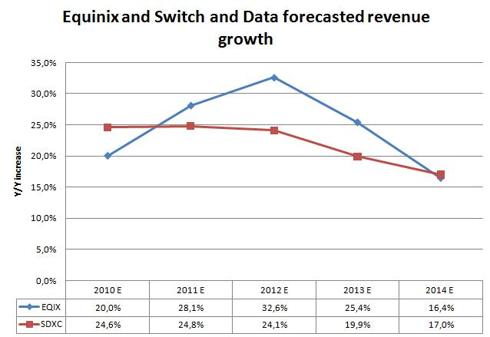

While these projections are based on several variables (you may read the full disclaimer at page 48 of the filing), they do represent an interesting analysis of how management is forecasting the future of the sector and their performance. For example, both Equinix and Switch and Data predict growth above 20% for the next 4 years, with a drop below this level just in the 5th year:

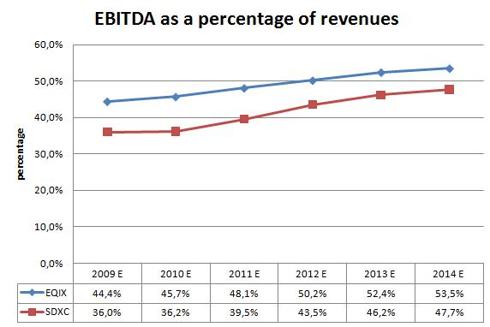

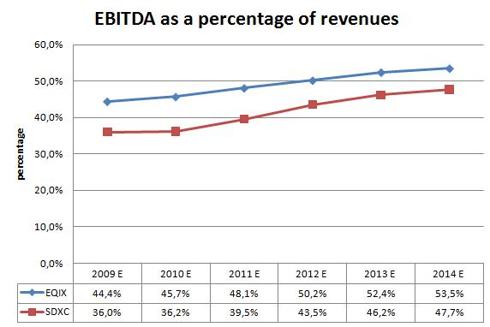

Another similarity we may find in both predictions is related to the EBITDA growth, which is seen improving both as an absolute number and as a percentage of revenues (from 44,4% in 2009 to 53,5% in 2014 for Equinix, and from 36% to 47,7% in the same time frame for Switch and Data).

Both Companies also expect EBITDA to exceed CAPEX in 2012 (EBITDA is a very close proxy for cash flow).

While the scope of this article is an update of the news related to the SDXC acquisition, we can't keep ourselves from analyzing some of these Equinix numbers on a (still) stand alone Company basis (an exercise mainly made to focus our readers' attention on the EBITDA and cash flow dynamics of this business model, the two metrics we favor to analyze this Company).

Assuming Equinix can achieve the growth predicted, the Company is expected to reach an EBITDA of about $1.4 billion in 2014, a number which we translate into roughly $ 1.25 billion of cash flow. With less than 40 million shares outstanding (excluding converts and options, plus obviously new shares issued for the SDXC acquisition, as here we are using EQIX numbers only), we would get over $ 30 per share of EBITDA/cash flow – whatever multiple you may decide to use for a correct valuation, in this scenario the current market price of about $ 100 per share doesn't really sound over valued.

The acquisition of Switch and Data won't change dramatically the picture, and we await more data at the next conference call to do additional financial modelings for the combined Company.

Disclosure: Long EQIX