Saturday, March 6, 2010

demand for information services is growing

>>Even as data centers strive to reduce power consumption, they must deal with the reality that demand for information services is growing. Storage needs are booming, as is global Internet traffic and use of mobile Internet devices, says Brian Lillie, who is CIO of co-location provider Equinix and the keynote speaker at the Data Center World conference.

...

Today’s data center manager is demanding “six 9s or better,” he says. “Reliability is one of the biggest concerns, and embedded in that is they need power. Power is probably the largest issue they’re dealing with.”

Friday, March 5, 2010

Strong Data Center Demand Seen for 2010

>>Strong Data Center Demand Seen for 2010

...

Financing is a Factor

“Demand has been pretty steady,” said Dan Golding, Managing Director at DH Capital, an investment bank specialized in hosting and telecom deals. “The story has really been supply. It’s been very, very difficult for people to finance new data centers.”

At the national level, the pending demand for data center space may be three times greater than the available supply of quality space, according to Jim Kerrigan, the director of the data center practice at the real estate firm Grubb & Ellis. “All those deals that got shelved in 2009 because the CFO said no .. they’re going to happen,” said Kerrigan.

Thursday, March 4, 2010

Equinix Said to Seek $170 Million Loan to Fund Asian Expansion

>>Equinix Said to Seek $170 Million Loan to Fund Asian Expansion

By Katrina Nicholas

March 4 (Bloomberg) -- Equinix Inc., the data-center operator for companies including Microsoft Corp., hired four lenders to help it borrow $170 million for expansion in Asia, according to two people familiar with the matter.

DBS Group Holdings Ltd., General Electric Capital Corp., ING Groep NV and Royal Bank of Scotland Group Plc will help Foster City, California-based Equinix get a five-year loan, said the people, who asked not to be named as the plan is private.

The term loan may pay interest of 4 percentage points more than the London interbank offered rate, one of the people said. No-one could be reached for comment at Equinix’s main office after normal U.S. business hours today.

Wednesday, March 3, 2010

Touch Screens that Touch Back

>>Touch Screens that Touch Back

New piezoelectric technology will make screens more tactile.

Forget putting your phone on vibrate. A novel "high-definition" touch-feedback display can give a touch screen the feel of a textured surface. The technology was developed for mobile devices by the San Jose CA-based company Immersion, and is a step toward mimicking the feel of physical buttons on flat screens.

...

Immersion is experimenting with making the digit at the center of the virtual dial pad feel as if it stands out more than the other keys. This would make it easier for the user to feel where the other keys are, says Kingsley-Jones.

What's most interesting about Immersion's approach, according to Hayward, is the lateral movement of the screen. Because it's difficult for nerves to distinguish the direction of such movement, it's possible to trick the senses into feeling upward pressure where there is none, he says.

Immersion is also developing software to record the feel of a real button and replicate that on-screen. In blind tests, subjects were unable to distinguish between pressing a real button and a simulated one, says Kingsley-Jones.

Immersion is talking to handset manufacturers and expects the first devices incorporating the technology to appear toward the end of the year.

Tuesday, March 2, 2010

3rd European Workshop on Stereotactic Radiation Therapy and Whole Body Radiosurgery

|

Pr. Vincent Grégoire |

Pr. Eric Lartigau |

Pr. Peter Levendag |

Monday, March 1, 2010

MultiCare opens new regional cancer center

MultiCare Health System opened Tacoma's first comprehensive Cancer Care Center today in the new Milgard Pavilion at MultiCare Tacoma General Hospital.

...

The Center offers:

-- Capacity for 40 semi-private and private infusion chairs set up in pods of six that will accommodate individual preferences for social interaction or privacy. 33 chairs for chemotherapy - nearly double the current 18 chairs at Tacoma General. Each chair has a personal entertainment system with television, radio and Internet access. And many of the treatment rooms have sweeping views of the Tacoma skyline and Mount Rainier;

-- An expanded radiation oncology center equipped with an image-guided linear accelerator and other state-of-the-art technologies including a CyberKnife robotic linear accelerator to be installed by summer 2010. The ceiling above the linear accelerator is decorated with glass art providing a soothing experience during treatments;

Access Pharma (ACCP.OB) Product Development Update – Sponsored Post

Access Pharmaceuticals (OTC: ACCP.OB, “Access”) develops and commercializes products for the treatment and supportive care of cancer patients, including:

- MuGard, an FDA-approved rinse for the management of patients with oral mucositis, a debilitating side effect of various cancer treatments

- ProLindac, now in Phase II clinical testing of patients with ovarian cancer

- The Cobalamin Platform, a drug delivery system for the oral administration of large molecules that are currently administered via injection (insulin, human growth hormone, fertility drugs, etc.)

MuGard has been commercially launched by Access' partner, SpePharm, in six European countries, including the UK, Germany, Italy, Norway, Greece and Sweden. Over 15,000 bottles of MuGard have been used by over 2,000 patients to date. Access is now conducting pre-marketing activities, including ramping of commercial production, with the goal of a U.S. commercial launch by April 2010.

ProLindac is a next-generation DACH platinum anti-cancer compound which includes a proprietary nano-polymer drug delivery vehicle that allows for over ten-times the dose of platinum to be delivered in a targeted manner to cancer cells, with a much better safety profile compared to standard platinum-based drugs which cause significant and cumulative neurotoxicity.

Access will conduct a combination study evaluating ProLindac with Taxol (paclitaxel) for second-line treatment of platinum pre-treated patients with advanced ovarian cancer. This is a multi-center study being conducted in Europe in up to 25 patients with primary efficacy endpoint goal of achieving at least a 63% response rate. Access expects to begin patient dosing by April 2010.

The Cobalamin Platform is a drug delivery technology that involves coating a nano-particle with a vitamin B-12 analog (cobalamin) that binds to intrinsic factor in the gut and triggers binding to cellular receptors which absorb the entire package, resulting in exponential increases in absorption through the gut of large molecule drugs/hormones typically administered by injection.

In June 2009, Access announced that two bio-pharmaceutical companies would conduct preclinical, proof-of-concept studies in animals (rat and dog models of diabetes) before proceeding to more formal negotiations for the Company's oral, long-acting (basal) insulin product candidate. Final results from the non-exclusive collaborators are possible during Q1 2010.

For more information on Access, visit the ProActive Capital Newsroom at www.proactivenewsroom.com.

This post was placed by IR GRO.

Equinix and Switch and Data 4Q 2009 results

Both Equinix (EQIX) and Switch and Data (SDXC) recently reported earnings. Here are the links to the Equinix and Switch and Data P/Rs announcing 4Q and full year 2009 financial and operating results. Equinix 4Q conference call transcripts are available, on Seeking Alpha, at this link.

Previous to that, Switch and Data shareholders approved the acquisition by Equinix, with more than 99% of votes in favor of the merger, and holders of more than 85% of Switch and Data's outstanding common stock participating in the vote. The only remaining obstacle to the combination of the two Companies is now represented by the Department of Justice investigation for anti-trust purposes. The Companies expect the closing of the merger to take place in the 2Q 2010, assuming the DoJ green light will be obtained.

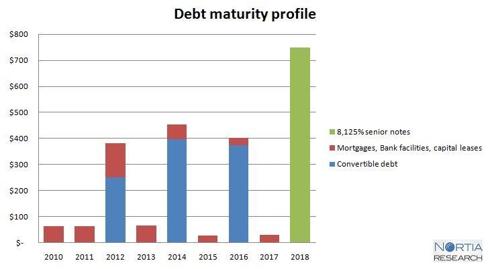

In order to finance the Switch and Data acquisition, including the repayment of the indebtedness that it expects to assume, Equinix announced, on February 22, a $500 million public offering of senior notes due 2018.

Given market response, on February 26 Equinix announced that it had entered into an underwriting agreement to sell $750 million of 8.125% senior unsecured notes due 2018, increasing the original offer of an additional $250 million.

Equinix intends to use the net proceeds from this offering also for general corporate purposes, which may include expansion capital expenditures. As a side note, about $300 million are expected to be needed for the cash portion of the Switch & Data acquisition and repayment of that company's debt at closing. More info about the offering are available in this SEC filing, including the rating on the notes, and we'll add more comments about it later in this article.

A quick look at some highlights from 4Q results, starting with Equinix:

- Equinix reported 2009 annual revenues of $882.5 million, a 25% increase over the previous year;

- 2009 annual adjusted EBITDA was $408.6 million, a 40% increase over 2008;

- The Company issued 2010 annual revenue guidance of $1,050.0 million to $1,075.0 million

Without digging too much into the usual metrics we check for a better understanding of the Company's performance, we'll simply resume that Equinix showed, once more, solid growth, well above Street estimates, and strong performance across all regions. You may check several interesting Equinix non-financial metrics at this link. However, 1Q 2010 outlook was probably slightly below Street expectations (partially due to lower expectations from foreign subs due to the recent stronger US dollar performance), while yearly guidance was basically in line.

A very interesting analysis, after the conference call, came from Michael Rollins (Citigroup):

- "Our study of ongoing capital spending intensity shows the potential for higher capital intensity than long-term guidance, which is dilutive to our valuation analysis.

- "Our bottom-up analysis of capital spending coupled with our analysis of gross PP&E suggests that capital spending for the existing portfolio is likely to stay in a range between 7% and 10% of revenue over time, implying an economic useful life of 20-32 years, versus EQIX guidance of 5% or a useful life of 40 years."

These comments might be worth a specific article, in the meantime, it's worth reporting that Citi's target price, for these reasons, was reduced to $ 106, but remains above the current share price:

- However, we believe returns for the business model remain on a solid footing and we may revisit our thesis if the share price pulls back to the $80-90 range given the support levels implied by our discretionary FCF/share analysis.

Also Switch and Data delivered very good numbers:

- total revenues increased to $205.4 million from $171.5 million for the year ended December 31, 2008, an increase of 20% ;

- adjusted EBITDA increased to $76.3 million from $56.5 million in 2008, an increase of 35%;

- billed cabinets increased from 8,110 in the third quarter 2009 to 8,588 in the fourth quarter. This was the largest sequential growth in billed cabinets in over three years.

It's worth noting that both Companies suffered acquisition related expenses in the 4Q worth a few million dollars.

It is also interesting that, as disclosed on Switch and Data 10-K filing:

- over 50% of new sales in 2009 were in our new or expanded data centers.

As the major expansion made by SDXC was the new data center in the New York metro area, this bodes well as to the results obtained in the financial vertical. Switch and Data ahas also disclosed additional wins in this area, like Chi-X Canada that will, by the end of the second quarter, relocate its primary data centre to Switch and Data’s Front Street facility in Toronto.

A look back at the Equinix conference call, to report some comments that attracted our attention:

- Stephen M. Smith - CEO

- A final note in this region, we’re excited to announce that we have made a decision to enter the Shanghai market through a partnership with a local firm named Shanghai Data Solutions. This agreement will allow Equinix to resell capacity in their datacenter to our multinational customers who have a requirement to have a presence in this market. We’ve selected a great partner to enter this new market and have high confidence that we will be successful executing this opportunity.

Equinix is not new to these kind of deals (with a similar one executed in Thailand a while ago), but the importance of the Chinese market makes this a more interesting opportunity than in the past.

It may be worth spending a little more time examining Equinix debt maturity profile, after the new financing:

Here are a few related comments made during the call:

- Keith D. Taylor

- Turning to our balance sheet and cash flows, at the end of Q4 our unrestricted cash balance totaled $604.4 million, a $23 million decrease over the prior quarter. We continue to benefit from strong operating performance including strong customer collections as our global DSOs decreased to 24 days and lower than expected cash payments related to our capital expenditures.

- Looking forward we’re going to assess our opportunity to refinance our existing debt facilities. Hopefully without using equity or an equity linked structure. Although we have not finalized the next steps we’re going to review each of our debt facilities in Europe, Asia Pacific and the US to determine what is the optimum structure given the opportunity in front of us. As part of this initiative we’ll look to maintain the greatest degree of flexibility while attempting to drive down our weighted average cost of capital on an after tax basis.

Standard and Poor's comments are worth reporting as they resume several interesting aspects of this financing (the rating is available at this link, registration required):

- Standard & Poor's expects that the company will remain aggressive in expanding its data center facilities over the next several years either through organic expansion or acquisitions. Equinix has plans to add capacity in several markets in 2010

- We are lowering the issue rating on the company's proposed unsecured note issue, which was upsized to $750 million from $500 million, to 'B+' from 'BB-' and revising the recovery rating to '3' from '2'.

- We are also affirming the 'B+' corporate credit rating on the company, since the upsized debt issue does not materially change the company's overall credit profile.

- The positive outlook reflects our expectation of continued strong organic growth in data center leasing business demand over the next year.

- "While these activities limit its net free cash flow generating ability over the next few years," added Ms. Cosentino, "they provide the platform for higher longer term cash flow generating ability."

This is a key point of this business model: Equinix is putting a lot of cash on its balance sheet to have the flexibility to continue in its aggressive built out of new facilities (or acquisitions) to grow the business, achieve scale, increase its market share. With the growth of the business, the Company is building a larger "cash cow" for the future.

With the SDXC merger to finalise and the synergies and integration challenges that it will bring, new products being offered and new expansions planned, as Rob Powell commented on his Telecom Rumblings web site:

Sunday, February 28, 2010

Equinix Inc. 'B+' Corporate Credit Rating Affirmed; Unsecured Note Rating Lowered To 'B+'

>>Equinix Inc. 'B+' Corporate Credit Rating Affirmed; Unsecured Note Rating Lowered To 'B+'

- U.S. data center and interconnection provider Equinix's leverage, pro

forma for the Switch & Data acquisition and the proposed refinancing, has

improved since 2008. - We are lowering the issue rating on the company's proposed unsecured note

issue, which was upsized to $750 million from $500 million, to 'B+' from

'BB-' and revising the recovery rating to '3' from '2'. - We are also affirming the 'B+' corporate credit rating on the company,

since the upsized debt issue does not materially change the company's

overall credit profile. - The positive outlook reflects our expectation of continued strong organic

growth in data center leasing business demand over the next year.

Samsung to leverage Yu-na's Olympic success

>>Samsung to leverage Yu-na's Olympic success

Samsung said it plans to pick 200 of those who purchase "Yu-na's Haptic" phone or one of its smartphone Omina models and to invite them to a fan meeting with the star athlete. The company has also started a series of promotional events in which it will give away free gifts to those who buy its products

Samsung said Yu-na's Haptic phone was one of its fastest-selling handsets, with its sales exceeding 1 million units in seven months of its rollout.