On December 10, 2008, Equinix held a very interesting web cast:

The discussion was targeting many aspects of the colocation business and Equinix product offer, but the main interest, from an investor point of view, was Dan Golding's speach about the state of the sector, and his forecast for the close future.

Here's the agenda of the web cast:

Dan is VP and Research Director at Tier 1 Research, an independent advisory firm covering the IT and Telecom Sectors. Founded by Andrew Schroepfer, T1R is probably the best analyst team in the colocation sector.

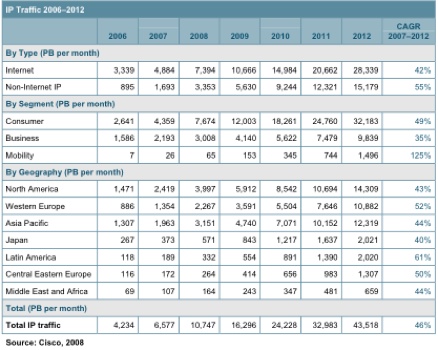

Dan Golding's presentation was enriched by a few slides, that help focusing on some tends in the industry. Obviously, given the economic climate right now, looking into the crystal ball is harder than ever, but recent results in the sector, and several different channel checks we have done recently, all seem to point in the same direction for this sector.

Most slides are quite self explaining, but we'll try to put a few personal notes and facts as additional comments to Dan's points.

Let's divide this small summary of the web cast into a few sessions:

The credit crunch and its effect on colocation

Colocation is a very capital intensive business. Building a data center, given today's power and security requirements, costs now around 1,300 $ per sqft. A new build also requires about 18 months to be completed. Utilization is growing nicely with most of the Companies in this business, and in the last 12/18 months financing new data centers has become more difficult. Not all Companies enjoy such a rich cash flow from operations to be able to look at new builds without need for accessing the credit market.

A great example of this problem is what happened to DuPont Fabros (DFT) recently.

In October DuPont Fabros Technology announced that they had halted the development of a data center in the Silicon Valley.

>>Development Update

In August 2008, the Company commenced construction on a $270 million wholesale data center in Santa Clara, California, based on the expectation of higher loan proceeds from ACC4. Due to the level of loan proceeds obtained, development at the Santa Clara site has been temporarily suspended.

Development of ACC5 in Ashburn, Virginia and NJ1 in Piscataway, New Jersey are progressing. The Company expects to complete both developments as planned assuming additional loan proceeds are obtained.<<

As Rich Miller noticed in his article on Data Center Knowledge at that time:

>>DuPont Fabros paid $22 million to purchase its 17-acre Santa Clara site last December. The company’s plans called for a pair of 300,000 square foot data center buildings with a power capacity of 72.8 megawatts.

Santa Clara has been a favored market for data center development because the city’s utility, Silicon Valley Power, has significantly cheaper power (about 7 cents per kilowatt hour) than many other areas of Silicon Valley. That has led Facebook and Yahoo to announced major leases of new space in Santa Clara this year. Earlier this year DuPont Fabros expressed enthusiasm about its Silicon Valley project.

“I think (Santa Clara) is one of the best markets in the country, and I wish we had product available sooner,” Fateh said. “Historically, from an Internet standpoint, that’s been the best market in the country.”<<

During their conference call on November 6, DFT comments still were very positive about the opportunities going ahead for the business (from Seeking Alpha DuPont Fabros 3Q 2008 Transcripts):

>>Like many companies, we're navigating through an incredibly challenging credit environment. The good news in this credit crunch is that over the next several years, it will curtail the introduction of speculative supplies. This environment should maintain the supply/demand imbalance that we see in place and should support attractive pricing for wholesale data center space.

In addition, companies that in the past may have used their own balance sheets to build new data centers will now look to us as an outsourcing solution. Just over the last few weeks, we're seeing increased interest from companies that were previously in discussion with private developers. These developers are now unable to complete their projects.

We're also seeing increased interest from companies that are revisiting the outsource as a build model. To a large expect, much of our competition comes from tenants wanting to build themselves. The current environment has somewhat eliminated this option. We suspected that the credit crunch would create more demand for outsource.<<

Unfortunately, soon after the call the Company came out with more bad news, even in spite of its decision to suspend the divident:

>>More Datacenter Construction Suspended (from Telecom Rumblings)

DuPont Fabros (DFT), which builds and operates datacenters as a REIT, has suspended construction at both its NJ-1 (Piscataway NJ) and ACC-5 (Ashburn VA) sites. This follows the news of three weeks ago that their Santa Clara project had been suspended. The company had just raised $100M but had needed far more than that to continue in Santa Clara. Well, apparently they need more to finish in New Jersey and Virginia as well, because this news effectively suspends their construction across the board.

Looking at the numbers, it is clear that Dupont Fabros cannot expand without access to the credit markets, their cash balance just can’t support it. And with the maturity of a mortgage on their new Chicago facility maturing in late 2009 to the tune of $120M, clearly they decided that discretion is the better part of valor. One has to assume that this situation is temporary, the datacenter sector is just screaming along and actually needs these facilities to meet demand. The suspension is an entirely artificial situation that will eventually work itself out one way or another. But in the short term competitors who are also building out space may benefit with improved pricing and uptake rates.<<

The credit crunch seems, so far, to be mainly a colo supply crunch, in the words of Dan Golding during the web cast, as few data centers are still in construction at the moment.

Very similar comments to DuPont Fabros were recently made by Equinix CEO, Stephen M. Smith, during the company's latest conference call (from Seeking Alpha Equinix 3Q 2008 transcripts), although the main difference is that Equinix expansion plan is fully funded:

>>Finally, limited access to capital could also further choke of incremental competitive supply from unfunded and speculative players over the next couple of years particularly given the cost in lead time to build a new data center. With the capacity we already have in place, a fully funded expansion plan as well as a strong balance sheet and operating cash flows we feel that we are well positioned to capitalize on growing our business in this environment.

How is demand doing?

Demand is probably diminishing, although at a lower rate that supply is disappearing. In percentage numbers, demand still seems to be growing at a two digit number rate, as it looks like for most companies more data center space is part of their mission critical infrastructure – something you may need to slow down on a bit, but not something you can stop adding completely.

Even Companies like Google or Microsoft are slowing down their construction plans, a sign that they may have revised their growth requirements: (from Data Center Knowledge)

Google has told the state of North Carolina that it won’t meet the job creation criteria for a $4.7 million state grant for its data center project in Lenoir, N.C. The grant required the company to create 200 jobs in four years, but Google has apparently slowed the pace of its project.

Last month Google suspended construction on its planned data center in Pryor, Oklahoma. The company says it remains committed to the $600 million project, and that work will resume when the company needs additional data center capacity.

Microsoft (MSFT) has announced that it will cut data center spending, saying it plans to reduce capital expenditures for 2008 by $300 million for the remainder of its fiscal year. Rackspace (RAX) has also revised its spending timetable in San Antonio, where the company bought a former shopping mall and is converting it into its headquarters. <<

Google and Microsoft have a strategy of building their own, large data centers in area where the cost of energy is very low – but still need to buy space in Companies like Equinix (EQIX) or Switch and Data (SDXC) for their peering needs, a great growth driver for Companies offering network neutral colocation.

Here is a very helpful slide taken from Dan's presentation and showing Supply and Demand Delta:

Bottom line, the credit crunch seems to have hit the market just as supply seemed to be starting to reach demand – and will probably allow the players who are still growing their data center supply to enjoy even stronger pricing in the longer term.

Pricing in 2010-2011 – forecast

Assuming an economic recovery will start in 2010, it will take a while before new data centers will be available in the market – it's all about the long construction building cycles of these infrastructures.

Again, Dan is visualizing it in one of his slides:

IT spend is certainly going down at the moment, and some may assume that in these economic bad times the “you need my money” line might be used with supplier – colocation might be one of the few sectors where this strategy is less likely to work, as suppliers are aware that, in the longer term, supply and demand will be in their favor.

There are certainly a few Companies in the sector whose balance sheet, at the moment, will allow customer use some leverage in their negotiations, but, as usual, it is also about strategic choices (is a sound balance sheet one of your requirements in a supplier, before you decide to put your servers in its place?). Other suppliers are quite healthy, enjoying rich cash flows from operation at the moment.

Demand will also bounce back immediately as the economy recovers – see the immediate reaction in the Demand Delta in the previous slide, potentially increasing the gap between supply and demand after 2010.

Why 2009 is different from 2001

All those who have been through the data center glut of the post-2000 bubble are afraid there might be a repetition of that period.

Luckily, there are many differences to underline:

- the quality of customers is completely different now (while most of them in 2000 were new Internet Companies that did not survive as they had no business model);

- Data centers were ghost towns, with very low occupancy rate, or sold in the wrong way (more about this later on), while today we are reaching full occupancy in many data centers;

- the equipment hosted today in most data centers is revenue producing – not something customers can really do without;

- although some customers may go out of business, churn is still forecasted low by most Companies and this should not strongly impact the sector;

- Peering and having a presence in several different locations has become a “need” rather than a funny request by the CTO;

- outsourcing will be “in fashion again” while customers will have to fight themselves through the credit crunch and budget limitations, so avoiding own builds, that also need reaching a decent occupancy to make economic sense;

- the growth of the Internet is there to stay, as discussed later on in the web cast, and will be strongly pushed by the consumer increasing its Internet usage.

- And finally, Companies have learned (the hard way...) from their previous mistakes, and will not repeat what they did in 2000 – as explained by this side comment taken from a post made by a former Equinix salesman: (from Feedbach forum)

>>Circling back to the example earlier of eBay over provisioning those 60 amps of power or 500 watts a foot in the 100 watt per foot designed facility and you quickly realize that you, as the vendor gave up 5 racks of space and associated revenue for everyone one rack of space that eBay pays for. And pays for at the lowest rate you ever did. The deal is 5X worse than you thought. Not only that, but the perception of your company to a stranger walking in to your facility is that you are struggling because your datacenter is only 20% occupied spacewise because those first 500 racks that ebay installed consumed all of the power and cooling resources. Now imagine your the vendor who didn't catch this overprovisioning issue until you had oversubscribed your mechanical plant by a factor of 2 or 3X and you have all customers usage creeping up simultaneously. What do you do then? You say, "this place could blow at any moment" :) Those of us who lived through those types of situations and conditions will never get in them again. The first time around can be chalked up to ignorance. The second time would only be stupidity. This thought is evidenced by the hard lines the vendors take today as it relates to placing limits on the amount of power per rack they will allow their customers to install. <<

Buy now?

Everything seems to point to a potential imbalance in supply and demand, in the longer term. What should a customer do?

Dan Golding's answer is very straight forward: buy as soon as you can. And, we would add, try to get a longer term deal, something some suppliers are considering at the moment, as it is also to their advantage to be able to get longer term commitments (with fixed price increased) in what is a great recurring revenue business model, so reducing the percentage of customers due for renewal every month (more than 4% if customers are on an average 2 year contract, 2.8% if they are on an average 3 year contract, around 2% on an average 4 year contract).

Locking prices may be a key advantage for the customers going forward. We have already seen it happening in the market place: Companies like Savvis (SVVS) and Internap (INAP) have dramatically increased prices for colocation once some old contracts expired in recent years, and this is what is happening in a few markets where supply is scarce (even in Europe) right now.

Power requirements

Another key point customers shouldn't forget in choosing their partner for colocation is the power requirement they might have – and suppliers should study this trend carefully to come out with the best offer for each market they supply.

This is a very interesting point for the industry, as high density centers bring along a very high construction price, and the recent events in the economy (energy prices going down dramatically, etc.) have somehow changed the macro economic scenario.

In spite of some recent forecasts, power requirements, in average, seem to be flat, Dan said, and power density in new builds is constant at the moment (and probably higher in the USA than Europe or Asia).

Several reasons might explain this trend, slightly different from previous expectations: the adoption of blade servers is slower than expected, and the impact of virtualization still limited in the colo sector, probably because a good level of efficiency in the use of servers was already there, driven by the pricing structure (per power usage and cabinet) of the sector.

Different customers also have completely different power needs: people using data centers for their peering needs mainly (Telecoms as well as the Google or Microsoft kind of customers in network neutral centers) still use the cabinets for routers and switches mainly, and need relatively little power (a reason why the legacy Equinix or Switch and Data centers, where most peering is happening, will not really need a power upgrade, and very often cabinets there are highly requested in spite of power limitations...), while banks will need very high power cabinets, making it necessary to plan well in advance the customers you are targeting in new builds – see this slide where Equinix explains that NY4, targeted at financial institutions, has also a different cooling approach to cabinets, among other things, etc.

Nortia Research final comments:

The colo sector should exit this difficult economic climate in a good shape – although, as always, it is extremely difficult to forecast entry points on single stocks as many unpredictable events may impact the share price.

We still prefer, among the players in the sector, the network neutral ones (like Equinix - EQIX and Switch and Data - SDXC), and Digital Realty Trust - DLR in the REIT sector (wholesaling to large enterprises, including Equinix itself in Europe and USA).

Other players are moving (or have already moved) their business model to a combination of several services, and offer colo as one of their products – like Navisite - NAVI, Internap - INAP, Savvis – SVVS – but might benefit from a positive trend in the sector.

An interesting comment, taken again from an old post on Feedbach Forum:

>>Data Centers are the Economy

The dependence on the data center today is far deeper and wider than it was in 1999. How could it not be? The Internet is no longer just another source for information threatening print, radio and television. It is THE source for information, THE source for education, THE source for communicating with individuals or to populations, THE source for commerce and trade, THE source for entertainment and THE source for a recession proof economy. At the heart of it all is the data center. The data center provides the platform which is enabling a more equitable distribution of wealth across a global stage.

…

There is a huge misconception that a glut of data center space is on the horizon. The fact is that perception is ill conceived and those who believe it and make investment decisions are ill informed and quite possibly passing up a once in a lifetime investment opportunity. <<

This is a very upbeat approach, more realistically, a sector worth putting on everyone's radar screen, as its development might be positive as the economy starts recovering.

Companies mentioned in the article: EQIX SDXC NAVI INAP DLR DFT SVVS