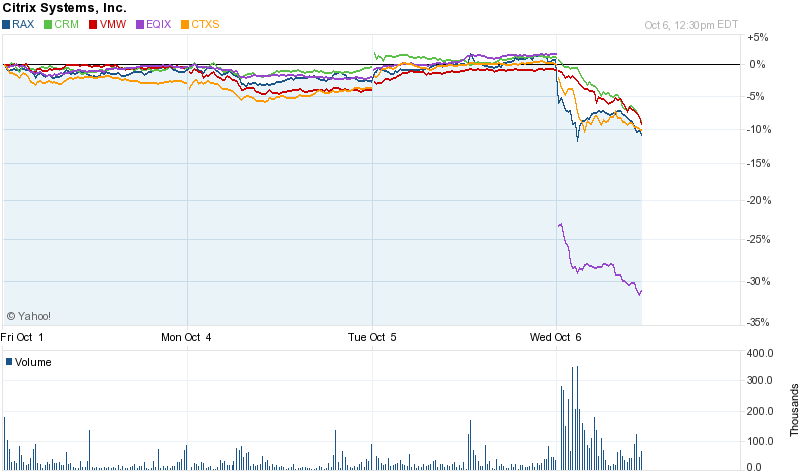

Equinix Inc. (EQIX) suffered the highest percentage decline in extended trading on Tuesday, October 5th, after the Company trimmed its revenue outlook for the third quarter and full year.

The stock fell 26% to $78.23. Volume of 4.1 million was more than five times the Company's daily average of around 800,000 shares. Equinix ended the regular session at $105.99, up 4%, on very strong volume, too.

With a history of exceeding guidance, and expectations for a strong second half of the year, it is not surprising to see the stock price take a hit because of concerns about growth – but is all this a bit overdone?

Let's try to go through some numbers first.

Equinix now sees revenue of $329 million (midpoint) for Q3, compared to its prior range of $335 million to $338 million (a $7.5 million miss, or 2,2%, at midpoint). Wall Street's current consensus estimate was for revenue of $336.8 million. For the full year, the Company expects revenue of $1.215 billion versus previous guidance of $1.225 billion to $1.235 billion (a $15 million miss, or 1,2%).

There was also a piece of good news, completely ignored by the market, as the Company announced that it expects to exceed its adjusted EBITDA target, in spite of the revenue miss.

Equinix is increasing its adjusted EBITDA outlook for Q3 to greater than $140.0 million (previous midpoint, $137,5 million). For the full year of 2010, the adjusted EBITDA outlook is also being increased to approximately $540.0 million (at the higher range of previous expectations). This increase is due in part to better than expected gross margins and lower than expected cash selling, general and administrative expenses.

There is still good leverage in the business, and the Company has already succeeded in bringing the recently acquired Switch and Data assets closer to the traditional Equinix's higher margin performance.

As a small reminder, adjusted EBITDA is a very close proxy to free cash flow for Equinix, and one of the most important metrics, in our opinion, to evaluate this business model. We'll come back to this later on.

In its post regular session conference call, the Company tried to address the reasons for this revenue miss, and why it was not possible to forecast it.

Equinix's management blamed three main factors for the negative result: underestimated churn assumptions in Equinix’s forecast models in North America, discounts to secure long-term contract renewals and impact from lower than expected revenue in Switch and Data.

As we noticed, we can quantify Equinix's forecasted revenue miss at about $15 million for the year.

Assuming a positive impact from foreign operations of about $3 millions, due to the recent weakness of the US dollar, we might round this number up to almost $ 20 million for 2010.

Half of it - or about $10 million – may be due to lower than expected turn over from Switch and Data.

Equinix now expects this recently acquired side of its business to achieve about $ 240 million in revenue for 2010 (as a reminder, Equinix consolidated Switch and Data results only after its official acquisition of the Company, which closed on May 1, 2010).

Switch and Data achieved revenue of $ 205,4 million in 2009. We believe it may be important to bring this number up, as it gives the opportunity to underline that the acquired assets are still growing at a nice 17% Y/Y rate.

Equinix itself still expects to grow organically at about 20%, in spite of reduced guidance.

Aftermarket trading seemed to suggest two things: a general fear among investors that Equinix may not be considered a strong growth story any more (the Company was priced for perfection, so a hit due to this kind of disappointment was to be expected), and a major concern that the Switch and Data integration has been mismanaged.

Let's try to spend some time on this subject.

Equinix has a long history of successful integrations, mainly of foreign assets (i-STT in Singapore, Pihana Pacific in Asia, IXEurope in Europe). It would be quite surprising to see management fail in assimilating an asset in its very well known domestic market, especially since Switch and Data has always been a very similar business, characterized by very low customer churn (actually lower than Equinix itself), and a very strong interconnection side of the business (better than Equinix, in percentage).

If we look at Equinix's integration efforts from the cost side, it looks like the Company has already achieved, or is in process of achieving, the majority of its costs savings (about 75% of the $20 million forecasted will be accomplished, according to management’s comments, by year's end).

Switch and Data EBITDA has already been improved by about 7 basis points, and is targeted to move from about 35% to the Equinix's standards of roughly 45%.

Full system integration is forecasted for Q1 or Q2 2011, and while these things always provide some road bumps, we do not see it as a major cause of distraction for management.

The bad news from the call is that the Company has probably been slower than expected in integrating the two sales forces, and converting the Switch and Data pipeline into actual revenues. This might partially explain why the former SDXC is now expected to achieve revenues of about 4% lower than expected. A small miss at Switch and Data (in terms of almost stable revenues between Q1 and Q2) had already been noticed, but we hadn't perceived it as a red flag.

More digging will be necessary to separate execution problems from sales reasons (Switch and Data inventory was very interesting in absolute terms, but quite concentrated in a few markets – and Switch and Data admittedly was looking at Equinix's strength in sales to improve its performance).

Bottom line, we believe it is too soon to call the merger a failure. In the long term, Equinix presence in the US market will benefit from being in more markets, and added inventory.

Reviewing the Equinix conference call, we believe there are a couple of items that require even more emphasis than the Switch and Data analysis.

A major concern in this business has always been pricing.

The sector came back from the failures of the past, when several Companies overbuilt inventory and mostly went bankrupt giving it away at or under cost.

The landscape is now completely different. In the past Rome was built in a day, and lacked citizens (customers) to make it a valuable place. Nowadays most data centers are at very high occupancy rate (Equinix is at about 78% in the USA, including the Switch and Data assets, and used to be well over 80%), and customers need regularly to add new cabinets (growth comes mostly from the installed base).

Equinix, in our opinion, probably did a poor job communicating a strategic shift in contract length, thus suggesting that some kind of discounting in the sector is necessary, right now.

Talking about “credit memos” to major customers in order to secure long-term contract renewals sounded a lot, to some analysts, like admitting that there is some price pressure today in the market, and that's exactly what can explain an investors' run away from the sector.

David Gross, at Data Center Stocks, has an interesting analysis of this aspect and tries to explain why a $300,000 per month discount on a $ 75 million multi-year commitment shouldn't knock down a billion dollar Company.

Moving away from the discussion of how it was communicated to the market, we'll try to get to the bottom of this two sized problem: is there price pressure right now in the sector? Why is Equinix trying to move the average length of its contracts from 24 months to probably much more than that, especially with strategic customers?

We do not believe there should be serious concerns about pricing in the market, right now.

Price per cabinet is still strong, as there is more demand than offer in the market. We will obviously check carefully recurring revenues per cabinet equivalent from now on, but we do not expect a free fall, just probably a slower increase each quarter.

However, data center construction is now stronger than before, and this will bring to more inventory available in a few months/years. A few REIT operators are offering turn key solutions that may be appealing for some larger customers, including some Equinix ones.

Equinix's customer base has always included footprints by Companies like IBM (that used to be well over 10% of revenues), or Google, Microsoft, etc.

Going back in time, we remember when Google moved away from its very large footprint in Ashburn, (DC metro). In the longer term, good news for Equinix as it repriced the inventory at more profitable rates. Some Equinix customers might grow in such a way, that an internal solution or building (leasing) an entire data center will make economic sense.

They'll stick to Equinix, anyway, for their mission critical staff (interconnection business) or foreign assets.

This kind of churn is inevitable, and Equinix has probably already dealt with most of it.

We have now been more aware of two aspects of how Equinix is and will be dealing with its clientele, especially in the USA, and mainly in a couple of verticals (digital media and content providers).

First, some strategic customers, whose “magnet” is important to build an ecosystem inside an IBX (and create that domino effect that attracts other partners under the same roof) are being offered incentives, right now, to commit for longer terms contracts to avoid future price pressure (when more inventory will be coming in the market) and having to deal, potentially, with a vertical moving away from an IBX as the major catalyst is being offered an anchor deal somewhere else.

This is not good news for the balance sheet right now, but represents a strategic move for Equinix and part of what was described as moving away from “fulfilling demand” to “creating demand”, which might also mean selecting specific location verticals and taking care they have deep roots. “Paying a price on price” may be part of insuring long term stability (still with yearly price increases in most contracts).

Second, Equinix has clearly indicated to us that about 25% of its current clientele is a bread and butter “need a cabinet for my servers” customer – these are the ones who are not very sticky to the Company, as this kind of service may be easily provided by others (although without the same security, quality of service or network density).

Moving to differentiating the offering and emphasizing the cross connection side of the business will only maximize the results, in the long term, for the Company.

Even in the worst case scenario (all these customers moving away to cheaper offerings, something impossible to happen), we do not have to forget that they are mostly subject to multi-year contracts, and the impact on churn would only add a few percentage points per quarter – not trying to underestimate the impact, but put it in the right perspective.

The challenge is now on the sales force, as it will have not only to increase its efforts, as a performance above targets will be necessary to offset a potentially higher churn, but focus on selecting customers based on their interconnection potential, and “stickiness” to the business model.

There is still a positive imbalance in the demand/offer dynamics of the sector, so we do not have to assume that it's mission impossible.

Equinix is already planning adding new people to the sales team, which is not a major concern in terms of additional costs, as the Company remains relatively “small” in terms of total employees. It might, however, take time to gain productivity on the investment.

We can now read with a different approach into a recent Press Release announcing the creation of a new position, Chief Sales Officer, and appointing Charles Meyers as President of North America.

Peter Ferris has been in charge of Equinix's sales since the very beginning, including the tough times after the bubble burst. In his new role as Chief Sales Officer, he will lead the Equinix go-to-market strategy, and manage global accounts and sales operations.

In summary, we now do expect a lot of volatility, as swing traders will join in, both long and short. Equinix has always had a strong institutional presence, including many hedge funds, and this will also play a role in the short term stock performance.

While we understand that it might take some time before the market recognizes that the business model is not broken, we remain confident that Equinix still represents an interesting investment opportunity for the long term.