The system resides in Equinix -powered data centers. CampusEAI Consortium’s 24x7x365 network operations center monitors the uptime and security of the enterprise applications in CampusEAI Private Cloud.

Saturday, July 31, 2010

2nd CK in Nevada: Las Vegas Cyberknife at Summerlin

>>2nd CK in Nevada: Las Vegas Cyberknife at Summerlin

At CyberKnife of Las Vegas, we’re giving patients new reasons for hope in their fight against cancer. To begin with, CyberKnife creates cancer treatment options that previously didn’t exist. For tumors considered medically inoperable and patients who are ineligible for surgery or chemotherapy, CyberKnife stereotactic radiosurgery can serve as an outstanding alternative

Immersion career opportunity

| Applications Engineer | |

| Location: | Tokyo, Japan |

| Requistion #: | IC2010-25 |

Job Description:

A new CK in Hyderabad, India??

>>A new CK in Hyderabad, India??

** translated from German **

Review improvisationsfreudigen a surgeon on the sidelines

23/07/2010

by Dr. Andrea Vincenzo Braga

South India - 14 hot days, short nights 13 - 22 hospitals - eight South Indian cities

22/04/2010

....

Diary Part 2:

Hyderabad, 3 until 02.04.2010

Integrated care and telemedicine operated schulbuchmässig

My new driver brings me to the airport with the funny Amarutha Castle Hotel. Like a medieval castle is built up ... only the droning techno music from the disco on the first floor will not quite fit it. A hearty breakfast must be to the tight schedule allows no lunch.

Another Apollo Hospital is on the program. This recording is overflowing, the interior renovation simple, but ok. At the other end of the corridor I expect an oasis of marble and stylish ambiance, the Platinum Lounge. The founder of the Apollo Hospitals, Dr. Reddy is a genius with the utmost dedication. The director for international business receives me, the questionnaire is processed quickly and accurately. The house leaves nothing to be desired. The emergency department is extremely efficient, with private ambulance Park. Led by an internationally trained physician.

....

The new oncology center will be opened in three months. Outdoor grind the stone masons, interior specialists program the most advanced CYBERKNIFE. to see before radiation oncology are flowers and fruits of sacrifice. A shaman performs a spiritual act - the way, is also prayed together briefly before each operation. It lacks neither the latest ultra high resolution CT (computer tomography) or an MRI (layer X)

Shipment of Russia's 2nd CK arrived Chelyabinsk

>>Shipment of Russia's 2nd CK arrived Chelyabinsk

** translated from Russian **

Cyberknife arrived in Chelyabinsk in time. A unique system to combat cancer in the Oncological install

29/07/2010

Kibernozh (Cyberknife) taken from Hamburg. Installations for the removal of tumors throughout the body, including the most remote places (CyberKnife) will allow using tomography create three-dimensional model of the human body, ask a treatment program, and then attack the tumor or tumor. In fact, this robotic arm that is capable of due to the high accuracy of concentrating the target is smaller than one cubic centimeter and irradiate them with great power, at times greater than that used in conventional radiation therapy.

Installation of "Kibernozha" in the District Cancer Centre will take several weeks. For him, prepared a special room a three-meter walls. The first operations with the help would come with the end of the year. Today, the American system "Kibernayf" (Cyberknife) have no more than two dozen countries, most in the world of high-precision "knives" are no more than two hundred.

Friday, July 30, 2010

Cell Phone Units Up 13% In Q2

>>Cell Phone Units Up 13% In Q2

- Nokia (NOK) shipped 111.1 million handsets, growing 8%; they estimate the company’s market share at 36%, down from 38% a year ago. The firm notes that while the new N8 smart phone could held in the second half, the phone will be hampered by a lack of retail presence in the U.S.

- Samsung shipped 63.8 million units, up 22%. The research firm thinks the new Galaxy S smart phone has “gotten off to a relatively good start.”

- LG shipped 30.6 million handsets, up just 3%.

- Research In Motion (RIMM) shipped 11.2 million phones, up 40% from a year ago, but the firm ntoes that its position in North American is coming under pressure from Apple (AAPL) and Android. “The Blackberry OS 6 upgrade, which should deliver a better touchscreen user-experience in time for the western holiday season, is sorely needed to improve its outlook in North America,” the research firm says.

- Sony Ericsson shipped 11 million handsets in the quarter, down 20%.

- Apple (AAPL) shipped 8.4 million iPhones, up 61%; it now has almost 3% market share, up from 2%. But Strategy Analytics writes that “Apple may have lost some heartshare in recent weeks because of its perceived mishandling of the antenna problem, and Apple will have to work hard during the second half of the year to stop lost heartshare converting into lost marketshare.” (Uh, I’ve heard of mindshare, but “heartshare”?)

- Motorola (MOT) shipped 8.3 million handsets, a third of those smart phones; units were barely more than half of the year-ago level, as the company reinvents itself as a specialist in Android-based smart phones.

Strategy Analytics sees Q3 shipments of 325 million phones, up 12%.

Cell phone shipments continue to recover

>>Cell phone shipments continue to recover

NEW YORK (AP) -- The number of cell phones shipped worldwide rose 14.5 percent in the second quarter compared with a year earlier, with much of the growth coming from smaller challengers like the iPhone and BlackBerry, according to research firm IDC.

Manufacturers shipped 317.5 million phones in the quarter, IDC said in its report late Thursday...

Nokia Corp. of Finland is still the world's largest maker of phones, but its growth is slower than the industry's and its share of the market is 35 percent compared to 40 percent two years ago. Motorola Inc. has fallen to seventh place in the world from number three. Samsung Electronics Co. and LG Electronics Inc., both based in South Korea, are No. 2 and 3.

Meanwhile, Research In Motion Ltd., the maker of the BlackBerry is now the fourth-largest maker of phones worldwide, shipping 11.2 million units. Close behind is Apple Inc., with 8.4 million units and HTC Corp. of Taiwan, with 6.5 million.

Equinix Continues to Execute

>>Equinix Continues to Execute

As Equinix begins to consolidate its new assets into the mix, we like the direction the firm is heading. Revenues were up 39% from the year-ago quarter, with North America being the star of the show (up more than 62% year-over-year), which includes two months of Switch and Data consolidation. Although the Switch and Data merger helped boost sales, injecting in the lower margin assets dropped the North American EBITDA margin 4 percentage points to 46.7%.

Increased Scale Leaves EQIX In Dominant Market Position

>>Increased Scale Leaves EQIX In Dominant Market Position

Analysts at Oppenheimer & Co upgrade Equinix Inc (NASDAQ: EQIX) from "perform" to "outperform," while reducing their estimates for the company. The target price for EQIX is set to $115.

According to Oppenheimer & Co, “Our more constructive stance on EQIX shares is predicated on the following considerations: 1) improving visibility into 2H10/2011 growth trajectory with close of SDXC acquisition; 2) faster-than-expected realization of synergy benefits, generating margin expansion in 4Q10 and beyond; 3) increased scale leaves EQIX in a dominant market

JP Morgan Gives ‘Overweight’ Rating To Equinix, Inc (EQIX)

>>JP Morgan Gives ‘Overweight’ Rating To Equinix, Inc (EQIX)

JPMorgan has released a research report on global data service Company

...

The analysts feel that the company will continue to grow over next two quarters, citing the fact that the company is poised to take market share in collocation services. Hence, the company will have more visible revenue growth.

Samsung results

from Bloomberg.com, emphasis added.

>>LCD TVs

Global shipments of LCD TVs may rise 24 percent to more than 180 million units in 2010, Austin, Texas-based DisplaySearch said in March. Samsung, the world’s largest TV maker, said in January it expects to sell 35 million LCD sets this year.

Samsung, also the world’s second-largest maker of mobile phones, said profit from the telecommunications division fell 36 percent to 630 billion won as the company lagged behind Apple and BlackBerry-maker Research In Motion Ltd. in the smartphone market. Second-quarter handset shipments climbed 22 percent to 63.8 million year on year, Samsung said.Worldwide sales of smartphones will increase 36 percent to 247 million in 2010 and expand 30 percent next year, El Segundo, California-based research company Isuppli said in April.

Samsung aims to more than double its share of the smartphone market, helped by the introduction of the Galaxy S model, Lee Donjoo, senior vice president of the company’s Mobile Communications Division, said on June 21.

...

>>Samsung sold 63.8 mobile phones in the second quarter, down from 64.3 million units sold in the previous quarter,

Thursday, July 29, 2010

Wikipedia out of Equinix Ashburn in 2011

>>Q&A: Jay Walsh, spokesperson for Wikimedia

(WEB HOST INDUSTRY REVIEW) -- As a non-profit organization, the Wikimedia Foundation (www.wikimedia.org) has relied on the donations of individuals and groups to maintain the popular Wikipedia (www.wikipedia.org), and its other sites.

WHIR: What makes Virginia an ideal location to build the second US data center?

JW: Wikimedia Foundation projects are important to hundreds of millions of people now, and they deserve to be hosted in the best possible way. Most of the top 10 websites in the world host at least part of their traffic out of Ashburn, Virginia because of the Equinix facility and their superior interconnectivity options. When we were visiting around in June we saw cages populated by very well known and high-traffic entities, which made us feel right at home.

...

Equinix 2Q Results: Switch and Data integration ahead of expectations

Equinix (EQIX) reported 2Q 2010 results last Wednesday night (see its Press Release and Seeking Alpha transcripts).

On separate Press Releases, the Company also announced the opening of DC6, its sixth IBX data center in the Washington, D.C. metropolitan area, with a capacity of 1,750 cabinets, and the third expansion phase within the Singapore SG2 IBX data center, that will add another 850 cabinets to that specific market (more on these expansions later).

Some highlights on a few metrics we usually follow for a better understanding the Company's performance:

- Revenues came at $ 296.1 million, at the low end of Company's guidance and met analysts' expectations. Exchange rate negatively impacted the 2Q revenues by $3.4 million

- 2Q EPS of -$0.05 may not be comparable to consensus, and the negative result was mainly impacted by restructuring, integration and acquisition costs related to the Switch and Data acquisition

- Churn remained at 2.2%, in line with Company's expectations

- 216 new customers in the quarter, including Switch and Data

- Cash gross margins remained at 65%, ahead of expectations

- Adjusted EBITDA came ahead of expectations, at $ 132.2 million, or 44.6% of revenues (as a reminder Switch and Data negatively impacted this metric, exiting 1Q with 35.9% against Equinix's 47.2%)

- Strong cabinet additions in all markets [over 800 in North America (combined Company), over 2,200 in Europe and over 300 in Asia Pacific]

- Record cross connects in Europe (plus 11.9%, or almost 1,200 new connections), as the interconnection business is getting traction in that market, too.

- 359 10 Gig ports on the Equinix exchange, and 160 on the Switch and Data corresponding service

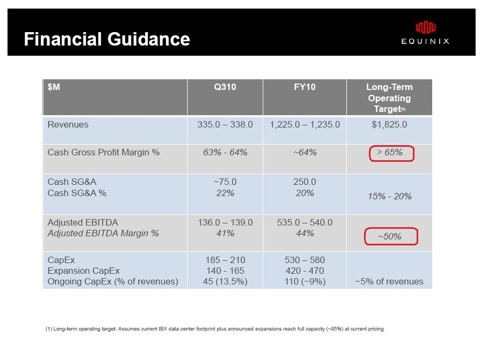

- Equinix narrowed 2010 guidance, lowering the mid point from $1,232.5 to 1,230 million (including a $ 4 million negative FX impact), but increased EBITDA guidance from $ 525 to $ 535 million to $ 535 to 540 million.

- Record bookings in all regions.

Back to the announced expansions.

DC6 will complement Equinix’s existing five data centers in the Washington, D.C. Market, that currently feature more than 470,000 square feet of data center space and access to more than 180 networks, making the campus one of the richest IP network interconnection points in the U.S., and the most important peering point on the East Coast.

The expansion, at full occupancy, will add about $ 40 million of revenues a year.

The newly announced Singapore expansion may come unexpected to some readers.

Singapore SG2 Phase 1 was launched in July 2009, with a capacity of 700 cabinets. More than 500 cabinets (or 75%) are now billing, and the recently announced Phase 2, due to open in September 2010 with a capacity of 1,000 cabinets, is already nicely booked. Some comments, recently published on the Business Times Singapore (subscribers only, a quote is available on our blog) may add some color to the story:

'We continued to experience strong growth within the Asia-Pacific region even during the global recession in 2009, and more so this year,' Mr Lee (Equinix's Asia-Pacific president) says. 'In fact, last year we opened a second DC in both Singapore and Sydney, and expanded our Hong Kong DC as well. This year the boom is back and we should see a strong surge in enterprise data. Much of that data would need to sit in DCs.'

In 2008, Singapore had a total of about 170,000 sq m of DC capacity, up 15 per cent over 2007. Not much capacity was added in 2009 due to the recession in 2008. But in 2010, demand may outstrip supply by up to 20 per cent, according to industry sources. Apart from Equinix, there are a slew of DC players such as SingTel, NCS, Tata Communications, ST Engineering and Fujitsu Asia.

According to industry analysts, the demand for DC space significantly outpaces supply in the Asia-Pacific, including Japan (APJ) region, with 50 per cent of the demand being driven by government initiatives, and the rest by Internet media, telecom and IT companies.

'Demand for DC hosting currently exceeds supply,' research house Frost & Sullivan's analyst Wu Chengyu says. 'In fact, over 80 per cent of the major DCs in the Asia-Pacific are running at close to 90 per cent capacity, and space is at a premium.'

1Q Red Flags

Some readers may remind that Equinix added 100 cabinets only in the USA (on a weighted average basis, the metric we prefer) during the first quarter of 2010. Looking at quarter end cabinets equivalents billing, the result was even worse, as the Company showed a zero net addition.

This quarter's result (more than 600 organic cabinets added by Equinix alone, plus about 200 by the former Switch and Data at quarter end), bring Equinix back to its standards.

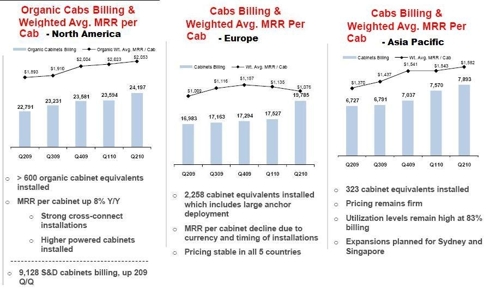

Here is an interesting view of cabinets' billing and weighted MRR for each region (slides from Equinix Earnings conference call Presentation, click to enlarge):

Excluding currency fluctuations for Europe (and Asia to a lesser degree), monthly recurring revenues per cabinets show continuous strength, as customers keep adding more services (cross connects, etc.) and pricing remains stable in all markets served by Equinix. Switch and Data is basically in line with Equinix as far as cabinet MRR in the North American market.

Switch and Data

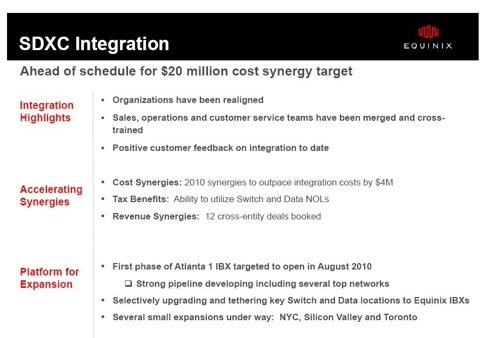

While we were a bit disappointed by the former Switch and Data result in the quarter (lower than our expectations, in spite of a good cabinets addition), Equinix stated that the integration is ahead of schedule, and the first sales synergies are emerging between the footprints of the two former separate Companies.

Equinix is working on standardizing metrics between the two Companies, and will have to wait for 2Q for additional color on this.

On the cost side, Equinix now expects to be able to achieve about 75% of synergy savings by year end, a steady improvement from the previous forecast of about 50%.

Financial vertical

During the call management reiterated that the Financial vertical is representing today a very strong market worldwide, as already noted by some competitors like SAVVIS (SVVS) during its recent conference call (Seeking Alpha transcripts):

Jim Ousley

Last week I spent a day with our lead salespeople from around the world, and I can tell you the message was loud and clear. The financial vertical has returned to strength. The challenges from 2008 and 2009 are behind the financial companies and there’s been an important change in how many of these companies are thinking about their IT requirements.

An interesting article on the role of the neutral data center in 21st century trading has recently been published by Equinix's Robin Manicom, director of financial services:

The complexity and volume of electronic trading has increased exponentially over the past decade as the financial industry continues to invest heavily in computer-driven technology. The Financial Information Forum reports that from 2006 to 2009 peak messages per second increased more than fivefold, leaping from 314,733 to 1,795,348 – and this growth rate continues its climb unabated.

This evolving landscape means today’s market participants are under unprecedented pressure to process higher and higher volumes of data – and fulfil their increasing compliance obligations – all without compromising their ability to execute their trades in real-time. It is this requirement that has placed technology at the very centre of trading in the 21st century. And if technology has become the key facilitator for trading, then it is fair to conclude that the neutral data centre has become the cornerstone for the rapidly expanding world of global financial markets.

We'll come back with more thoughts about Equinix's results later on, but for the time being we would like to end the article looking at the long term potential of the Company.

Equinix's growth has made it difficult to evaluate the real strength of the business model. Each time a new data center opens, costs associated with the ramp up of operations (employees, etc.) put a shadow on the Company's real performance.

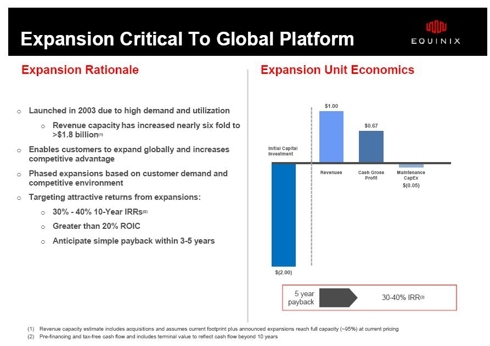

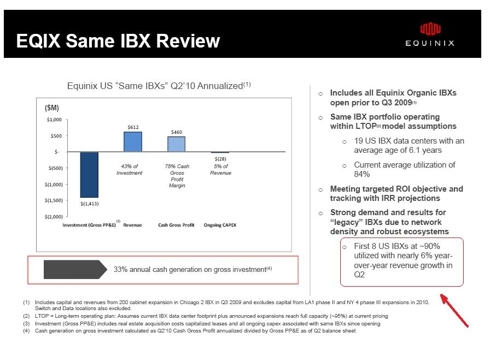

Some of the slides prepared by Equinix for this quarter's call help put some numbers in perspective, both for the expansion rationale and the long term operating plan (emphasis added):

Wednesday, July 28, 2010

LG TV

from tgdaily.com:

>>The segment is hot, hot hotStrong demand for LCD TVs and lower pricing are both contributing to increased sales of the units.

Market research company DisplaySearch said that in Q3 2009, sales were up year on year in terms of units for the first time in a year.

And next year that growth will continue, with the analysts predicting total shipments will rise from 205 million units this year to 218 million units next year. That represents a six percent increase.

CampusEAI Consortium Announces Private Cloud for Higher Education

FOR IMMEDIATE RELEASE

PRLog (Press Release) – Jul 28, 2010 – CLEVELAND - July 27, 2010 - CampusEAI Consortium today announced the availability of the CampusEAI Consortium Private Cloud for higher education. The CampusEAI Private Cloud is powered by industry vendors and service providers including Dell (Nasdaq GS: DELL), AT&T (NYSE:The system resides in Equinix -powered data centers. CampusEAI Consortium’s 24x7x365 network operations center monitors the uptime and security of the enterprise applications in CampusEAI Private Cloud.

LG TV

>>Lucky Gold Star put our CapSense into their new flat-panel TV. That’s a big trend right now. When you have a sleek black flat-panel TV, you don’t want ordinary knobs and buttons sticking out of the bottom. So we’re getting a lot of CapSense business on that.

While it is too soon to speculate if Immersion's technology might be used (although LG is a customer and the chip includes Immersion's technology), it may be appropriate to study the potential market.

This is taken from Bloomberg:

Global shipments of LCD TVs may rise 19 percent to about 169 million units in 2010, according to El Segundo, California- based ISuppli Corp. in May.

Isupply also forecasts 78 million units of 3D TVs in 2015.

More info from Twice.com:

>>LG Display commanded the biggest portion of large-sized LCD panel unit shipments in the first quarter, at 24.9 percent. The company now is expanding its capacity at its advanced 8.5 generation LCD fabs.

Samsung, with 22.4 percent share of unit shipments, also is plowing capital outlay into adding more 8.5 generation capacity.

In terms of large-sized LCD panel revenue, however, the two Korean giants trade places, with Samsung ranked at the top and LG Display in second.

Global production by area for large-sized LCD panels is projected to rise significantly as more capacity comes online in 2010. Production by area for large-sized LCD panels will rise 7 percent sequentially during the fourth quarter of 2010, leading to a 44 percent annual expansion for the entire year. Growth then will continue unabated for the next year, with production by area increasing 16 percent in 2011.

LG Electronics 2Q

>>LG Electronics Inc. (066570.SE) said Wednesday its second-quarter net profit fell 33% from a year earlier as many of its key businesses, including cell phones and flat-screen televisions, suffered from a slowdown in key European export markets.

LG saw its cellphone division deliver disappointing results in the second quarter. Although the company sold more handsets, it had to slash prices to boost sales, resulting in the division posting an operating loss margin of 3.5%, compared with a 0.9% profit margin in the first quarter.

During the second quarter, the company sold 30.6 million handsets, up from 27.1 million units in the first quarter.Competition in the smartphone space has been intensifying as LG's rivals, including Apple Inc. and Samsung Electronics Co., gain more ground. Although analysts expect the results to pick up from the third quarter onwards, they note that LG's handset business may not record a turnaround until the fourth quarter when the company is slated to roll out new smartphones running on Google Inc.'s Android operating system.

At LG's home entertainment division, which makes flat-screen TVs and plasma display panels, operating profit fell to KRW28.1 billion in the second quarter from KRW267.8 billion a year earlier. Sales rose 19% to KRW5.361 trillion from KRW4.504 trillion.

Equinix Earnings Preview For Q2/2010

>>Equinix will report earnings tonight.

This quarter will also include Switch and Data revenues (from May 1st), and the conference call will represent an interesting update on the integration efforts (and planned future developments) of the combined Company, the dominant US neutral colo player.

Read more at this link.

Pacnet joins $447m Sydney-US undersea cable

>>Pacnet joins $447m Sydney-US undersea cable

Pacnet was also said to be "aggressively" examining options to build its own data centres. It currently has space shared between Global Switch and Equinix's IBX facility in Sydney.

Baron Funds Quarterly Letter

>>On Equinix

Despite receiving approval to close its Switch & Data acquisition in February, which had been weighing on the shares for months, Equinix shares ultimately traded down in the second quarter, due to weakening currencies and then concerns about a double dip recession. Equinix has some exposure to the euro and the British pound, but we believe that the impact in terms of translated financials is modest. Meanwhile, end-demand for the company’s data centers has remained robust, and the company is on track to continue to fill its available capacity, while adding new capacity as needed around the world. Management continues to be disciplined in reinvesting its excess cash flow, targeting expansions that drive attractive returns on investment, while the base business continues to be characterized by a high degree of recurring revenue. (Rich Rosenstein)

Tuesday, July 27, 2010

Immersion 2Q 2010 Earnings Preview

Immersion (IMMR) will be reporting 2Q 2010 results on August 5th.

The Company surprised on the upside in the 1Q, for a combination of factors that included a stronger than expected performance in product sales, and also some seasonality (as royalties on products like mobile phones and gaming, that are sold in higher volumes in the Christmas holiday period, are recognized in the subsequent quarter).

Immersion is transitioning toward a licensing model only.

The Company recently completed the sale of its medical division to CAE Healthcare (CAE), and for this reason it will not recognize any product sale, from this segment, in the quarter. It must be noted, however, that due to the delayed timing of royalty recognition, it will not recognize any license revenue stream from CAE, too, in the 2Q.

In our opinion, it is important to remind that it would be fair, for a real apple to apple comparison, to analyze 2Q results against the 1Q excluding product sales (that accounted for about $2 Million in the 1Q), and keeping in mind that seasonality and the lack of royalties from the medical division sold to CAE will certainly play an important role in the final numbers. We are obviously hoping that management will give out as many details as possible on the matter to help investors get a proper understanding of the Company's performance.

During the last conference call, Immersion guided for revenues in the $6.2 to $6.7 Million range (from Seeking Alpha 1Q conference call transcripts):

Victor Viegas - CEO

In terms of our near-term outlook, we would expect total revenues in Q2 to be in the range of $6.2 million to $6.7 million, down on a comparative basis sequentially, reflecting our transition to a licensing model as well as typical downward seasonal trend based on our revenue recognition.

Analysts estimate revenues of $ 6.5 Million, and EPS of ($0.07).

On the cost side, the Company should start showing much lower operating expenses, due in part to the reduced headcount, following the transaction with CAE Healthcare, and also to lower legal and administrative fees.

Immersion ended the 1Q with $ 64,6 million of cash and cash equivalents, and while we do expect some cash burn in this quarter, it is a Company's target to reduce costs in order to be cash flow positive with revenues of just around $7 Million a quarter.

During the quarter, the Company issued a limited number of press releases, mainly related to the Medical segment.

Immersion announced a license agreement with SOFAR S.p.A., a leading Italian manufacturer of medical devices for minimally invasive surgery, and, probably more important, the conclusion of a litigation with Simbionix USA Corporation, the world's leading provider of simulation and training products for medical professionals and the healthcare industry, that has now become a licensee, too.

As the official flow of information from the Company was relatively quiet in the quarter, we will be looking for more information about the sectors Immersion is targeting from some of its licensees.

As we write, one of Immersion's partners in the semiconductor segment, Cypress Corporation (CY) reported 1Q results. Some of their comments may be worth a quote (from Seeking Alpha transcripts, our comments in Italic):

Brad Buss – CFO

We expect record revenue for PSoC in TrueTouch in the third quarter and for the entire fiscal year 2010. (see: Next-Generation Cypress TrueTouch™ and CapSense® Solutions Enable Innovative Products with Tactile Feedback to Improve User Experience)

Ashish Rao – Credit Suisse

Could you update us on where the TrueTouch revenues were for the quarter and if you’ve gone past the customer pick up that you saw in the March quarter and also as you look ahead to 2011, how do you view the tablet opportunity versus the predominantly handset smartphones today?

Norm Taffe

Hi, Ashish. This is Norm. So, I think the second part of your question was related to what kind of momentum we’re seeing in terms in the March quarter and going forward on touch. My answer to that is we continue to see great momentum there. In fact, we said another design win record in Q2 as far as wins in the touch space.

It is also interesting to note that both Immersion and Cypress seem to share the same interest as far as new segments to pursue for their products (emphasis added):

T.J. Rodgers

Lucky Gold Star put our CapSense into their new flat-panel TV. That’s a big trend right now. When you have a sleek black flat-panel TV, you don’t want ordinary knobs and buttons sticking out of the bottom. So we’re getting a lot of CapSense business on that.

In addition, we’ve gotten automotive qualified PSoC is capable of doing can and win, PSoC 3 can and rest are the win, which are the automotive bus standards, and that means that we allow quick integration of touchscreens into automobiles. We’ve been qualified, automotively qualified and our biggest win is the Chevrolet Volt, the new electric car where we are in the center panel of the car.

The mention of the Automotive market is interesting, as Immersion has been working with Visteon (VSTNQ) for quite some time.

For those who love speculations, we could mention that Brad W. Buss, Cypress Corporation's CFO, is also sitting on the BoD of Tesla Motors (TSLA), another car producer who might implement Immersion's product in its new Model S (this quote is taken from Immersion's 1Q 2009 conference call):

Clent Richardson

And Road and Track Magazine just gave a sneak peak at the new 2012 Tesla Model S highlighting its use of Haptics, noting a 17 inch touch screen entertainment system in the center console with Haptic interface.

Turning back to Cypress Semiconductors, a few more quotes about the trends in touchscreens, which confirm a good momentum in general and new customers' wins in the mobile phone arena for Cypress (emphasis added) - will Immersion benefit from this?

Adam Benjamin – Jefferies

Got you. And then Norm, a question for you on TrueTouch. You’ve kind of talked about $100 million as a number for this year. Based on what you’re seeing now plus or minus what do you think?

Norm Taffe

Based on what we’re doing right now, we’re still on track to more than double what we did last year. It’s not clear yet whether we’ll look to get all the way up to the $100 number but we’re certainly on our plan more for than double this year.

Brad Buss

And I think importantly, we added, we received the first significant orders from two more of the top eight handset suppliers this quarter, which are going to ramp for us in Q3 and Q4. So now we are shipping volume in Q3 at five of the top eight handset suppliers on touch and so the backlog is really starting to ramp for us.

Sunday, July 25, 2010

THE NEED FOR SPEED

>>Here at StockCharts, we are constantly looking for ways to get you our charts as quickly and consistently as possible. Much of the past two months has been spent adding and testing two different "web acceleration" technologies to our site in an effort to reduce the time it take for our charts to move across the Internet.

The first technology we tried came from a company called Akamai. While this technology works well for other websites and, at first, showed some promising results for us, when we dug deeper we discovered that it really wouldn't work well for us mainly because when the market is open our charts cannot be cached (i.e., saved for later reuse).

The second technology looks much more promising however. It is called "XIP" and it comes from InterNAP, the same company that currently connects us to the Internet. XIP dynamically adjusts the low-level settings that control how data flows across the Internet. It works best when transmitting large items (such as a chart) across long distances. The bigger the object and/or the longer the distance, the more XIP helps.

(Another really nice thing about XIP is that it doesn't require any changes to your computer - it's a change that we make here in our datacenter. No install, no settings to mess with, just improved speed - pretty nice!)

At this point we've completed our internal testing of XIP and the results look good. In our tests, XIP reduced the time it takes to send out our charts by 30 to 40% in most cases. That said, we now need your help. We want to make sure that if we switch to XIP it won't cause any problems for our users.