Equinix (EQIX) reported 2Q 2010 results last Wednesday night (see its Press Release and Seeking Alpha transcripts).

On separate Press Releases, the Company also announced the opening of DC6, its sixth IBX data center in the Washington, D.C. metropolitan area, with a capacity of 1,750 cabinets, and the third expansion phase within the Singapore SG2 IBX data center, that will add another 850 cabinets to that specific market (more on these expansions later).

Some highlights on a few metrics we usually follow for a better understanding the Company's performance:

- Revenues came at $ 296.1 million, at the low end of Company's guidance and met analysts' expectations. Exchange rate negatively impacted the 2Q revenues by $3.4 million

- 2Q EPS of -$0.05 may not be comparable to consensus, and the negative result was mainly impacted by restructuring, integration and acquisition costs related to the Switch and Data acquisition

- Churn remained at 2.2%, in line with Company's expectations

- 216 new customers in the quarter, including Switch and Data

- Cash gross margins remained at 65%, ahead of expectations

- Adjusted EBITDA came ahead of expectations, at $ 132.2 million, or 44.6% of revenues (as a reminder Switch and Data negatively impacted this metric, exiting 1Q with 35.9% against Equinix's 47.2%)

- Strong cabinet additions in all markets [over 800 in North America (combined Company), over 2,200 in Europe and over 300 in Asia Pacific]

- Record cross connects in Europe (plus 11.9%, or almost 1,200 new connections), as the interconnection business is getting traction in that market, too.

- 359 10 Gig ports on the Equinix exchange, and 160 on the Switch and Data corresponding service

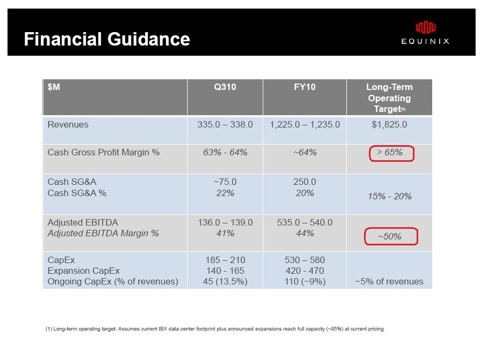

- Equinix narrowed 2010 guidance, lowering the mid point from $1,232.5 to 1,230 million (including a $ 4 million negative FX impact), but increased EBITDA guidance from $ 525 to $ 535 million to $ 535 to 540 million.

- Record bookings in all regions.

Back to the announced expansions.

DC6 will complement Equinix’s existing five data centers in the Washington, D.C. Market, that currently feature more than 470,000 square feet of data center space and access to more than 180 networks, making the campus one of the richest IP network interconnection points in the U.S., and the most important peering point on the East Coast.

The expansion, at full occupancy, will add about $ 40 million of revenues a year.

The newly announced Singapore expansion may come unexpected to some readers.

Singapore SG2 Phase 1 was launched in July 2009, with a capacity of 700 cabinets. More than 500 cabinets (or 75%) are now billing, and the recently announced Phase 2, due to open in September 2010 with a capacity of 1,000 cabinets, is already nicely booked. Some comments, recently published on the Business Times Singapore (subscribers only, a quote is available on our blog) may add some color to the story:

'We continued to experience strong growth within the Asia-Pacific region even during the global recession in 2009, and more so this year,' Mr Lee (Equinix's Asia-Pacific president) says. 'In fact, last year we opened a second DC in both Singapore and Sydney, and expanded our Hong Kong DC as well. This year the boom is back and we should see a strong surge in enterprise data. Much of that data would need to sit in DCs.'

In 2008, Singapore had a total of about 170,000 sq m of DC capacity, up 15 per cent over 2007. Not much capacity was added in 2009 due to the recession in 2008. But in 2010, demand may outstrip supply by up to 20 per cent, according to industry sources. Apart from Equinix, there are a slew of DC players such as SingTel, NCS, Tata Communications, ST Engineering and Fujitsu Asia.

According to industry analysts, the demand for DC space significantly outpaces supply in the Asia-Pacific, including Japan (APJ) region, with 50 per cent of the demand being driven by government initiatives, and the rest by Internet media, telecom and IT companies.

'Demand for DC hosting currently exceeds supply,' research house Frost & Sullivan's analyst Wu Chengyu says. 'In fact, over 80 per cent of the major DCs in the Asia-Pacific are running at close to 90 per cent capacity, and space is at a premium.'

1Q Red Flags

Some readers may remind that Equinix added 100 cabinets only in the USA (on a weighted average basis, the metric we prefer) during the first quarter of 2010. Looking at quarter end cabinets equivalents billing, the result was even worse, as the Company showed a zero net addition.

This quarter's result (more than 600 organic cabinets added by Equinix alone, plus about 200 by the former Switch and Data at quarter end), bring Equinix back to its standards.

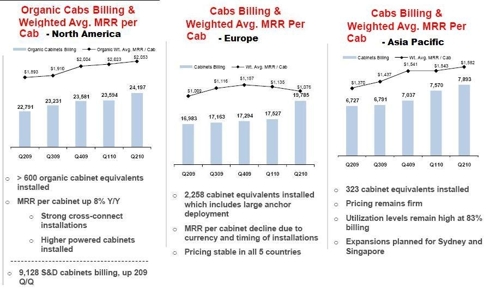

Here is an interesting view of cabinets' billing and weighted MRR for each region (slides from Equinix Earnings conference call Presentation, click to enlarge):

Excluding currency fluctuations for Europe (and Asia to a lesser degree), monthly recurring revenues per cabinets show continuous strength, as customers keep adding more services (cross connects, etc.) and pricing remains stable in all markets served by Equinix. Switch and Data is basically in line with Equinix as far as cabinet MRR in the North American market.

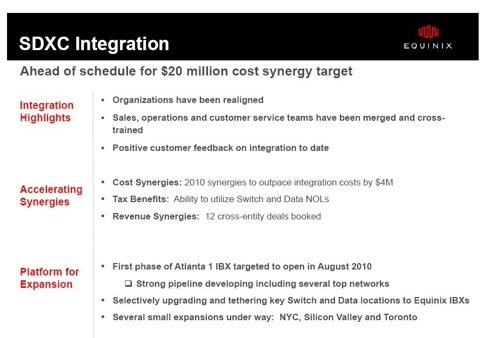

Switch and Data

While we were a bit disappointed by the former Switch and Data result in the quarter (lower than our expectations, in spite of a good cabinets addition), Equinix stated that the integration is ahead of schedule, and the first sales synergies are emerging between the footprints of the two former separate Companies.

Equinix is working on standardizing metrics between the two Companies, and will have to wait for 2Q for additional color on this.

On the cost side, Equinix now expects to be able to achieve about 75% of synergy savings by year end, a steady improvement from the previous forecast of about 50%.

Financial vertical

During the call management reiterated that the Financial vertical is representing today a very strong market worldwide, as already noted by some competitors like SAVVIS (SVVS) during its recent conference call (Seeking Alpha transcripts):

Jim Ousley

Last week I spent a day with our lead salespeople from around the world, and I can tell you the message was loud and clear. The financial vertical has returned to strength. The challenges from 2008 and 2009 are behind the financial companies and there’s been an important change in how many of these companies are thinking about their IT requirements.

An interesting article on the role of the neutral data center in 21st century trading has recently been published by Equinix's Robin Manicom, director of financial services:

The complexity and volume of electronic trading has increased exponentially over the past decade as the financial industry continues to invest heavily in computer-driven technology. The Financial Information Forum reports that from 2006 to 2009 peak messages per second increased more than fivefold, leaping from 314,733 to 1,795,348 – and this growth rate continues its climb unabated.

This evolving landscape means today’s market participants are under unprecedented pressure to process higher and higher volumes of data – and fulfil their increasing compliance obligations – all without compromising their ability to execute their trades in real-time. It is this requirement that has placed technology at the very centre of trading in the 21st century. And if technology has become the key facilitator for trading, then it is fair to conclude that the neutral data centre has become the cornerstone for the rapidly expanding world of global financial markets.

We'll come back with more thoughts about Equinix's results later on, but for the time being we would like to end the article looking at the long term potential of the Company.

Equinix's growth has made it difficult to evaluate the real strength of the business model. Each time a new data center opens, costs associated with the ramp up of operations (employees, etc.) put a shadow on the Company's real performance.

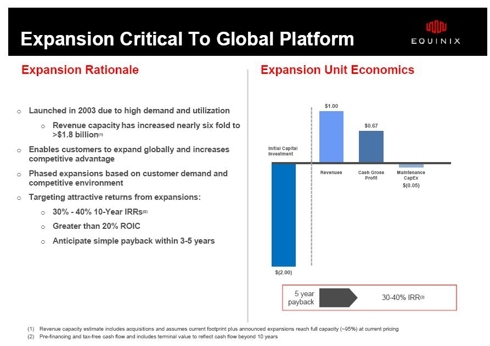

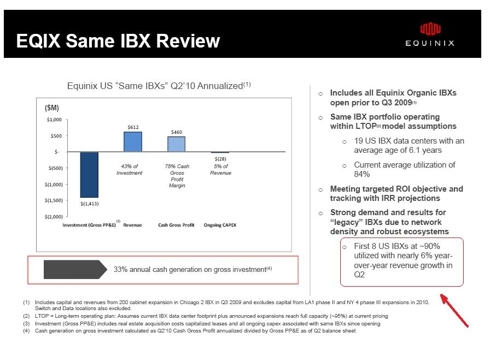

Some of the slides prepared by Equinix for this quarter's call help put some numbers in perspective, both for the expansion rationale and the long term operating plan (emphasis added):

No comments:

Post a Comment