Saturday, January 30, 2010

sales data

Aug 2007 – Dec 2009

EQUINIX INCORPORATED, Chicago, IL

Developed business cases, financial models, revenue targets and ROI analysis for datacenter and network infrastructure growth and expansion based on detailed research of technology, geography and partnerships.

Anticipates industry trends and the needs of customers.

Research and design Equinix Global Delivery Service Platform for Equinix customers in 18 global markets.

Sr. Account Executive

$597,930/New MRR Total US Equinix MRR 2009.

36 New Global Accounts Closed to Date, 2009.

Fully Booked MRR/kW Metric $1150, 2009.

46 New Global Accounts Closed in 2008

Fully Booked MRR/kW Metric $850, 2008

BlackRock now 5% owner - Immersion

This Amendment to Schedule 13G (this "Amendment")

is filed by BlackRock, Inc. ("BlackRock"). It amends

the most recent Schedule 13G filing, if any, made by

BlackRock and the most recent Schedule 13G filing,

if any, made by Barclays Global Investors, NA and

certain of its affiliates (Barclays Global Investors, NA

and such affiliates are collectively referred to as the

"BGI Entities") with respect to the subject class

of securities of the above-named issuer. As previously

announced, on December 1, 2009 BlackRock

completed its acquisition of Barclays Global Investors

from Barclays Bank PLC. As a result, [substantially all of]

the BGI Entities are now included as subsidiaries of

BlackRock for purposes of Schedule 13G filings.

Amount beneficially owned:

1519033

Percent of class

5.43%

Friday, January 29, 2010

2010 Stock Picks For Data Hosting And Storage Sector Of Web Services Industry

>>TWST: Tell us more about the pending acquisition of Switch & Data (SDXC) by Equinix (EQIX). What is your take on other acquisitions we might see in this space this year?

Mr. Weller: As far as Equinix and Switch, we are positive on the merits of that transaction. We think there are different angles to it. Equinix was able to get some increased capacity in certain big markets in the U.S., and there is no doubt that network-neutral, co-location has been a supply-constrained market. It also gives them an entree into second-tier markets. There should be some meaningful synergies in this transaction related to cost and revenue synergies, and I think they've talked about an initial number there in the $20 million area. Then there was, I believe, the defensive angle for this acquisition, too, in the filing related to the merger.

The other option for Switch & Data was a merger with an international company. So there are a couple of pretty big international network-neutral, co-location players that could have established a pretty good position in the U.S. with Switch, and that takes that off the table. The one uncertainty with respect to the acquisition is it still has not been approved by the U.S. Department of Justice. And actually last week, they issued a second request for information, as they're going to review that merger for antitrust issues. So we're still kind of waiting upon that, but we think ultimately the transaction is likely to go through. I'm not sure that kind of foretells a big increase in M&A in that sector. I think that transaction will likely be a little bit unique, although there are some angles. So if you think about 2010, I would think about a couple of different things.

First, I think it's possible you could see some of the up-and-coming private companies go public - companies like Telex and CoreSite that compete with Equinix. The other angle here would be that you do have some large international network-neutral, co-location providers that might look to still establish presence in the U.S. And so companies like Telecity (TCY.L) or Interxion could look to Telex and to CoreSite as M&A candidates. So I would expect that when we look back on 2010, you will see IPOs from these private companies, or they will be bought by some of the international players.

Equinix Netherlands Awarded Additional PCI-DSS Certification

Equinix Netherlands Awarded Additional PCI-DSS Certification

Payment Card Industry Lays Down High Security Demands For Credit Card Transactions

AMSTERDAM, 28 January 2010 – Equinix, Inc. (Nasdaq: EQIX), a provider of global data center services, has today announced that another of its data centers in the Netherlands complies with the Payment Card Industry – Data Security Standard (PCI-DSS) housing specifications.

Following in the footsteps of the Amsterdam facility (AM1), the data center in Enschede (EN1) now also meets the strict requirements governing the housing of credit card transactions. The PCI DSS certification is a standard for data security aimed at countering the increasing risks arising from the growth in electronic payment traffic. Equinix’s compliance with this standard will help its clients meet the stringent regulations, contributing to a more secure global e-commerce environment.

The PCI-DSS has been established to prevent criminals from being able to abuse the storage, transmission and processing of confidential transaction data. The standard is obligatory for every trader who processes credit card details. Severe fines and penalties are imposed on companies that do not comply with the standard. Companies that do not meet the specified requirements can thus be held liable for losses resulting from fraud.

Frank van der Heijden, Equinix’s Director Managed Services, says “As electronic payment traffic continues to grow rapidly, so too do risks such as credit card fraud, the most common form of identity theft, and the misuse of stolen credit card details. The security of business-critical information within an Equinix data center is absolutely essential to enable secure operations. With this compliance we enable our clients to easily meet the PCI-DSS requirements, allowing them to focus entirely on their core business.”

Thursday, January 28, 2010

Data Centers And Data Hosting Entering "Hyper Growth" According To Stifel Nicolaus Equity Analyst

>>The Wall Street Transcript has just published its Internet Services Report offering a timely review of the sector to serious investors and industry executives. This 50 page feature contains expert industry commentary through in-depth interviews with public company CEOs, Equity Analysts and Money Managers. The full issue is available by calling (212) 952-7433 or via The Wall Street Transcript Online.

>>For example, Salesforce.com (CRM), the largest software-as-a-service provider, doesn't operate its own data centers They are a customer of Equinix. And so we think Equinix (EQIX) should benefit as cloud service providers and others look to extend their data center space. Rackspace gives you another play on the cloud, where they are operating their own cloud service. So we would call them more of a cloud services provider as opposed to Equinix, which has more of an infrastructure play on it.

Embedded World 2010

Embedded World 2010

Victor Viegas, Interim CEO and Director

Immersion Corporation

Opinion for the haptics application market in 2010

Mobile phones have been a key driver for Immersion over the past several years. Debuting in the Korean

market almost 5 years ago, Immersion’s TouchSense haptic technology has shipped in over 70 million

mobile handsets worldwide. Initially found in high‐end feature phones, haptics is gaining popularity in

touchscreen phones. We expect this trend to continue as handsets continue to evolve and become

more complex and sophisticated. Manufacturers have recognized how critical user experience is to

consumers and that touch feedback makes products more efficient, intuitive and fun.

Immersion continues to innovate and recently announced the TouchSense 4000, a new solution that

leverages multiple actuators to provide “stereo‐quality” haptics. Just as stereo took audio listeners to a

more enjoyable listening experience, our TouchSense 4000 uses multiple actuators to create similar

stereo effects. Handsets will soon be able to provide different haptic effects in different physical areas

of the phone, and be able to vary those effects in a more sophisticated manner. We’re dedicated to

constantly improving and refining our solutions, integrating new technology and helping our partners

produce exceptional, differentiated products. Our research and development team are working on even

more innovations that we expect will launch later this year.

Immersion’s role to create the Korean mobile haptic culture

Korea has long been regarded as a leading and highly competitive market for the cell phone industry

where adoption of technology often occurs well ahead of the rest of the world. Samsung and LG, both

long‐time partners, were at the forefront of valuing touch feedback and integrating our technology in

their products. Early implementations included gaming, ringtone and music enhancements – and with

the advent of the touchscreen, we really saw haptic adoption take off. These key partners continue to

bring exciting, innovative products to market – it’s been a great validation of the value of our solutions.

We estimate that TouchSense technology is currently included in 25% of all touchscreen‐based phones

with that share continuing to grow. With Samsung and LG leading and proving consumer demand, we’ve

since licensed other manufacturers around the world.

Prospect for other industrial applications in Korea

We’re changing the way that people interact with technology. An early application for haptics that

continues to be a strong market for us is console gaming and peripherals; gamers have been clear, force

feedback/rumble is a requirement. While over the past several years our cell phone business has really

grown, we’re now seeing haptics being leveraged across a range of consumer electronics including

digital cameras, personal navigation devices, media players, laptops and tablet computers; we expect

this to continue. Other markets include appliances, office equipment and industrial controls – the

adoption of touchscreens in such a wide variety of products has resulted in great opportunities for us.

Another interesting market is automotive; our touch feedback technology is licensed to manufacturers

and suppliers to make navigating and controlling infotainment systems more intuitive and less

distracting.

What’s distinguishable from other competitors

Immersion is truly the leader in developing and licensing haptics technology. We were founded in 1993

and have since built a broad intellectual property portfolio of over 800 issued or patents pending in the

U.S. and other countries. Our solutions are sophisticated and reflect the best research and development

in the market. We’re enhancing user experiences by using touch feedback to increase satisfaction and

add an emotional element, as touch is our most intimate sense.

We partner with great companies who understand the value of touch and our innovations have resulted

in hundreds of products that integrate high‐fidelity haptic systems to power exceptional user

experiences.

http://www.immersion.com/about/news-room/docs/Embedded-World_Jan10-english.pdf

Czech Republic's 1st CK install in March, operational in May

>>Czech Republic's 1st CK install in March, operational in May

** Translated from Czech **

The new facility will be equipped with a special robotic device to treat malignant tumors, so-called cyber knife. CYBERKNIFE is perfectly capable of destroying small tumors by radiation in places other forms of treatment available, very difficult - the brain, pancreas, lungs and spine. Will be installed at the end of March and after the trials of radiation safety, we should start from May to use the treatment.

Firm Guiding Construction Stole Millions, Officials Say

>>But according to an investigator briefed on the case, the largest fraud occurred at data centers in Bergen County, N.J., that are owned by Equinix, formerly Switch and Data Facilities. The company was overcharged by about $3 million, the investigator said.

Wednesday, January 27, 2010

Chi-X experiences low latency benefits by outsourcing to Equinix

>>Outsourcing our platform to a specialist data center services provider was a logical step for Chi-X Europe.”

Following a full market evaluation of data center providers, Chi-X Europe selected Equinix as its vendor of choice, commencing work in August 2008. Critical to its decision to choose Equinix was the Equinix Financial eXchange, a global financial ecosystem consisting of financial market firms including buy and sell side firms, market data providers, technology providers as well as execution venues that locate with Equinix data centers to support highly reliable, low latency connectivity for a broad range of market participants.

As Miciu states: “The solution offered by Equinix successfully meets the needs of Chi-X Europe, with Equinix Financial eXchange also enabling participants to directly connect to an active community of strategic partners.

“Moreover, outsourcing to Equinix has meant an improvement in our operational efficiency, with the management of power, cooling and security all handled by the provider.”

Chi-X Europe initially hosted its platform at Equinix’s London Slough data centre (LD4). It has since opened a new Point of Presence (PoP) at Equinix’s Frankfurt data center (FR2), and has also housed a business continuity solution at Equinix’s Park Royal center in London (LD3).

The Benefits

The Benefits“Outsourcing to Equinix has given us a proven advantage over other MTFs by allowing our participants to directly connect to the platform, thus enabling them to bypass relatively expensive and unreliable network links,” comments Miciu.

“Not only have we achieved our initial aim of improving latency, but outsourcing has also enabled us to expand our customer base, thus further improving our return on investment.”

As Chi-X Europe continues to expand, partnering with a data center provider that can facilitate company growth is essential. “Equinix’s vision aligns completely with our own. Its ability to scale its services to meet the needs of our growing customer base is critical to our aggressive growth strategy.”

Exegy And Essex Radez Relaunch MarketDataPeaks.com, First Tool To Track Comprehensive Market Data Rates

Exegy Incorporated, the market data appliance company, has announced today that they are working with Essex Radez, a leading provider of direct exchange feeds and co-location services for algorithmic trading firms, as a partner on the first public website that tracks real-time market data rates every second of every trading day.

Called MarketDataPeaks.com (http://www.marketdatapeaks.com/), the site provides a minute-by-minute account of the aggregated volume of market data messages across major North American exchanges. The site highlights the peaks from the current day as well as historic peaks.

“This site is designed to provide unique information on peaks in market data to the financial community – trading firms, exchanges and regulators,” says Jeff Wells, V.P., Product Management at Exegy. “It helps executives stay on top of market data issues and plan for the future. Today, for example, the market peaked at 2,162,363 messages per second, a new all time high.”

Kerry Hindle, Director of Market Data Sales & Marketing at Essex Radez, said, “We are pleased to supply the market with this service. We know that every market data manager is interested to know when big peaks are occurring from a reliable third party, and by keeping up to date in real-time, the whole market will be in a better position.”

The historic data will be captured and included in the Financial Information Forum’s capacity statistics as part of the organization’s collaborative efforts to address issues that impact financial technology operations and development in light of rapid changes occurring in the marketplace.

“We look forward to giving our members insight into market data peaks based on this aggregated feed data,” says Manisha Kimmel, Executive Director of FIF. “We will include this unique data as part of the FIF Market Data Capacity Working Group discussions and this will allow us to further assist our members in planning and provisioning for market data growth.”

All data are processed and updated through a single Exegy Ticker Plant located within the Essex Radez data center at the Equinix NY4 facility in Secaucus, New Jersey. The 340,000 square foot, carrier neutral, Equinix facility is a major data distribution center for the new CBOE C2 platform, Direct Edge, ICE, ISE, BOX, and NASDAQ. In addition to Secaucus, Essex Radez operates co-location facilities in New York, Weehawken (New Jersey), and Chicago and provides all North American direct feeds over its private network.

MarketDataPeaks.com features the total number of messages that occur simultaneously in any given second across all live data feeds including NYSE/SIAC, NASDAQ, OPRA, CME, ARCA, BATS and Direct Edge, both Level 1 and 2. The graph displays the highest one-second aggregate peak that occurs in each minute. The graph on the site’s home page automatically updates every minute.

MarketDataPeaks.com is co-sponsored by Exegy, Essex Radez and the Financial Information Forum.

Sunday, January 24, 2010

Switch and Data removes an obstacle seeking to block the Equinix merger

Switch and Data (SDXC) recently settled three shareholder class action lawsuits, thus removing a few more obstacles toward its sale to Equinix (EQIX).

- In connection with this settlement, the three lawsuits and all claims asserted therein would be dismissed with prejudice, including the claims brought against Switch and Data and its directors. Switch and Data and the other defendants deny all of the allegations in the lawsuits and believe that the existing disclosures regarding the proposed merger are appropriate under the law. Nevertheless, Switch and Data and the other defendants have agreed to settle the putative class action lawsuits in order to eliminate the risk, burden and expense of further litigation, to fully resolve all claims raised in the lawsuits, to permit the merger to be consummated without the risk of injunctive relief or delay, and to permit Switch and Data's stockholders to receive the consideration provided for in the merger.

Switch and Data shareholders are expected to vote on the merger next January 29, and further to that the only remaining obstacle to the closing of the merger is the US Department of Justice investigation, as its green light is required for Antitrust reasons. However, this scrutiny has already contributed to delaying the Equinix and Switch and Data merger into the 2Q 2010.

To resume, Equinix and Switch and Data first filed a Notification and Report Forms with the Antitrust Division of the Department of Justice, whose waiting period under the HSR Act was due to expire on December 4, 2009. Later, Equinix voluntarily withdrew this application, and re-filed the form on December 7, 2009, thus extending the waiting period an additional 30 days to January 6, 2010. On that day, Equinix received a Request for Additional Information from the Antitrust Division. This second request basically extended the waiting period imposed by the HSR Act until 30 days after Equinix has substantially complied with it, and for this reason the Merger is not expected to close in the first quarter of 2010, as planned.

We are no lawyers, but we believe that, given the low single digit market share of the data center sector hold by the combined Companies, there should be no problem to get the deal authorized, unless the DoJ looks at the smaller network neutral sub-sector, or at the interconnection side of the business model (as both Equinix and Switch and Data are leaders when it comes to peering points, although this specific market is shared with other important competitors like TelX, etc. in the US).

More interesting from an investor point of view, a few more details about the merger were disclosed in a FORM 8-K filing, made on January 19, that gave additional insight into the combination of the Companies and the background to it.

- This Supplement supplements and amends the Proxy Statement dated December 21, 2009

- On January 19, 2010, counsel for parties in all three lawsuits entered into a memorandum of understanding in which they agreed upon the terms of a settlement of all lawsuits.

- As contemplated by the proposed settlement, Switch and Data is providing certain additional disclosures that are supplemental to those contained in the Proxy Statement.

We already noticed, in our article “Equinix Plus Switch & Data: Looking Forward” that the two Companies estimate cost synergies in the range of $20 million per year, as first revealed by Equinix during the NASDAQ OMX Investor Conference. It now appears that this is the low range of the synergies estimated by Switch and Data during the merger negotiations:

- During the discussion, it was noted that, unlike a transaction with the International Party (which, as discussed above, would have been structured as a merger of equals without any premium to Switch and Data’s stockholders), the proposed transaction with Equinix offered Switch and Data stockholders a significant premium for their Switch and Data common stock and was expected to create substantial synergies for the surviving entity. Mr. Olsen advised the board of directors that Switch and Data’s management estimated that a combination with Equinix could result in an annual reduction in expenses of approximately $20.0 million to $25.0 million due to the elimination of certain duplicate expenses and fee-based services.

We believe that these costs savings are achievable, once the integration is fully operative, and notice that they represent well over 10% of the cash costs of Switch and Data, per year.

Another small note, from the filing:

- The board of directors also determined not to aggressively seek to have a post-signing market check because, in the board of directors’ judgment, such a market check was unlikely to result in a more favorable proposal in light of the significant proposed premium, and during the course of the negotiations, it became apparent that insisting upon a post-signing market check would likely imperil the proposed transaction with Equinix.

Those readers who remember what happened after Equinix announced the acquisition of IX Europe probably don't need to be told why Equinix was not willing to leave this opportunity to Switch and Data shareholders (Equinix had to spend about $73.0 million more than originally forecasted for its European acquisition).

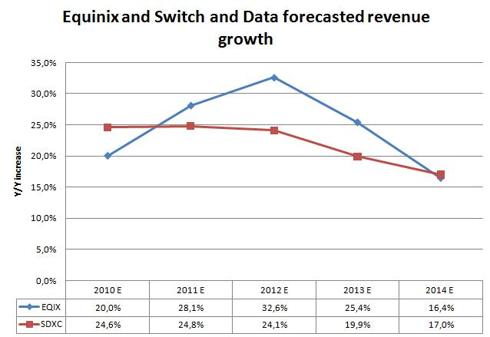

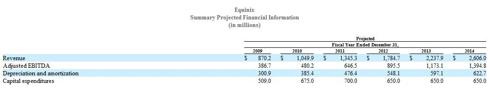

Getting back to our analysis of the business plans for the next few years, disclosed in a filing by both Equinix and Switch and Data, we recently got a few more comments which are worth a mention. As a reminder, both Equinix and Switch & Data predicted growth above 20% for the next 4 years, with a drop below this level just in the 5th year:

Here are the two “forecasts” (although we shouldn't use this word) - click to enlarge:

At the recent Citi Global Entertainment, Media, and Telecommunications Conference Keith Taylor, Equinix CFO, put the whole thing into the right prospective, as far as Equinix is concerned:

- What is included in the S-4 is basically a plan, a plan of what could we do over a five-year period. That plan is 2009, it’s lower than projected guidance for 2009. In fact, it’s lower — and that’s on the revenue line, and EBITDA line. And it gives you outlook to 2010 as well, and it’s slightly lower than what we give you on a growth rate for 2010.

There's also more insight into future CAPEX for expansion, thanks to a direct question by Citi analyst, which includes a comment about the financial vertical:

- Mike Rollins—Citi Investment Research—Analyst

- And just thinking about the investment that you are making in Switch & Data, does that then count towards some of that revenue capacity and CapEx? So in a way, is there a risk that looking at that plan is double accounting because in a way you are buying a lot of the capacity and some of the expansion that I think you were originally hoping to do.

- Keith Taylor—Equinix, Inc.—CFO

- The plan did not contemplate any duplication with Switch & Data. The only place where we will get a little bit of — not a little bit — more meaningful capacity is in New York, and we get a little bit of capacity in Dallas. But overall, these are all new markets that we want — that’s an organic plan where we wanted to be as an industry, or as a company. And so that’s what we think we can do. When you throw on Switch & Data, there’s an opportunity that is even greater. So I don’t think it’s going to displace any meaningful CapEx. I think it might defer it for a short period of time.

- But in New York, the biggest issue — and we’re quite concerned. Even though we’re in construction today for the final phase of our New York-4 Phase III asset, that we will run out of capacity very, very quickly because that gives you a sense of the pent-up demand for that asset.