One of the most entertaining exercises we enjoy every year around this time is to look back at our previous modelings for Immersion Corporation (IMMR).

Just referring to our Seeking Alpha articles, we started covering Immersion back in 2009 with the article “Immersion Q1 Forecast: Can It Bring Great Potential into Actual Revenues?”.

We are obviously still waiting for the Company to reach its inflection point, but nevertheless we decided to share with you our new forecast, so that, at least, as readers you can also enjoy the fun of looking back, in a few years, and say: “how wrong those guys were” (more seriously, we still believe Immersion could eventually turn into a decent investment, especially since the Company moved to a licensing model only. Realistically, it looks like it will take a few more years to reach a revenue level translating into good profits, assuming decent execution by management and increased adoption of haptic by new sectors/licensees).

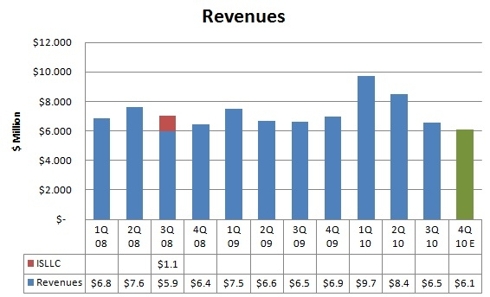

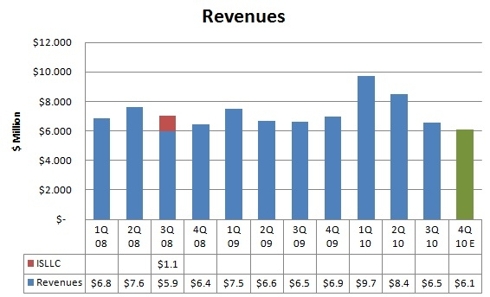

A quick look at past performance:

For Q4 2010 we used the mid point of Company's guidance, although we believe Immersion could achieve a better result than forecasted.

What the chart seems to suggest is that Immersion can not be really considered a growth story, and that revenues are actually declining in 2010, after a good start in Q1.

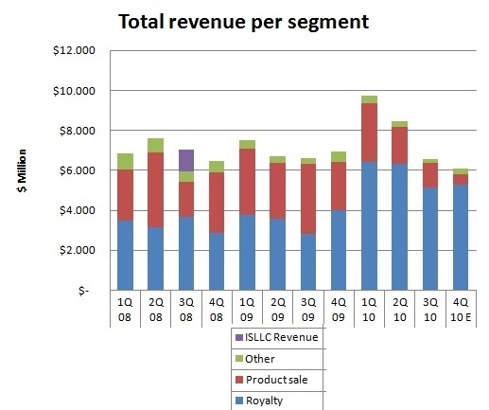

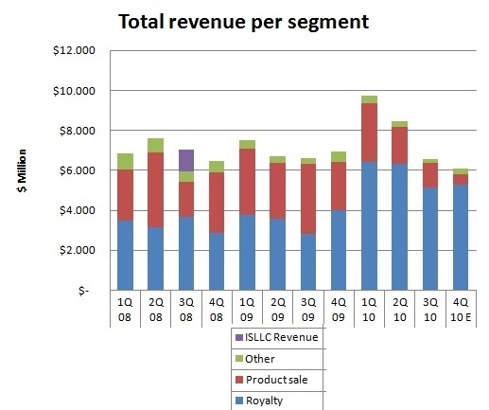

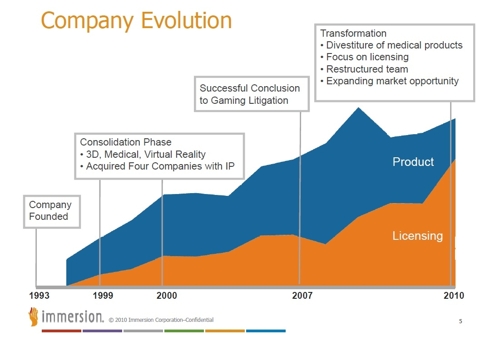

Those of you who know the Company understand that Immersion moved to a different business model in 2010, so that a better view of its performance is given by this chart:

Q1 is usually a stronger quarter, due to seasonality, and Q2 2010 saw some additional revenues as gaming licensees adjusted their royalty reports.

Year-to-date, Immersion's royalty business has grown about 75%, compared to 2009, while the discontinued product business has decreased by more than 30%, putting a large shadow on the Company's overall performance.

Going forward, there are a few positive trends that should allow Immersion to keep growing its revenue stream nicely.

The high adoption rates of smart phones worldwide will certainly represent the key driver for the Company's growth in the short period, given the relationships with Samsung (SSNLF.PK), Nokia (NOK) and LG (LGERF.PK), just to mention some key licensees. Tablets, like Samsung's GALAXY Tab, will add an additional revenue stream soon, as well casino gaming, as 3M (MMM) recently started, for example, producing a haptic roulette.

We also expect royalties from semiconductor partners - Companies like Atmel (ATML), Cypress semiconductor (CY) and IDT (IDTI) - to reach a decent level going forward, and longer term the Automotive sector should start benefiting from the implementation of haptics into several new models through the Visteon (VSTO.PK) partnership (2012, at least).

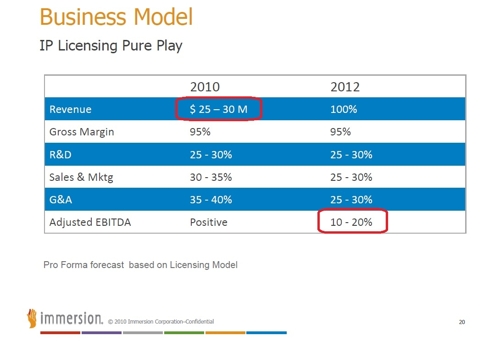

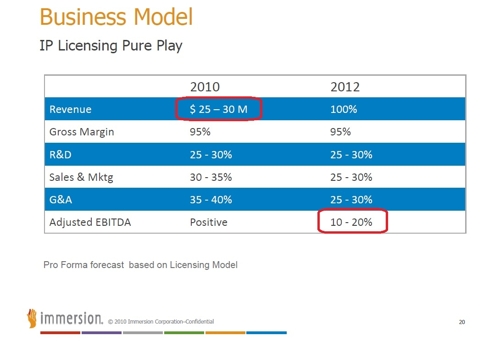

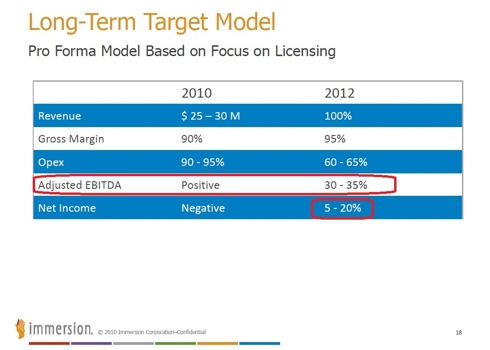

It is interesting to turn our attention to the latest investors presentations made by Immersion. We refer, in particular, to the sheet highlighting the long term business model.

This sheet is taken from Immersion's August presentation to investors.

We highlighted two data: 2010 Revenue and 2012 Adjusted EBITDA (forecasted).

The Company recently announced that it will most probably exceed the high range of its annual guidance, so that revenues for 2010 are expected to be around $ 31 Million (assuming the midpoint of Q4 guidance).

It's more interesting to look at what the Company was forecasting for adjusted EBITDA as a percentage of revenues (10% to 20%).

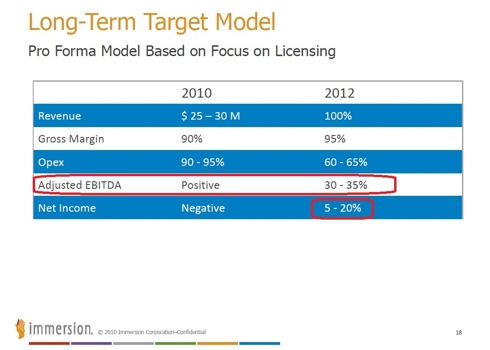

If we just turn to the same sheet on the November presentation, the Company seems comfortable in providing better numbers to investors:

As you may notice, Immersion is now forecasting Adjusted EBITDA to reach 30% to 35% of revenue in 2012, and Net Income of 5% to 20%.

Forecasts certainly don't commit management to achieving success, but we like to read into these improved numbers a deeper analysis of Immersion's cost structure, that should remain quite stable going forward, given the business model, and some improved expectations on the revenue side.

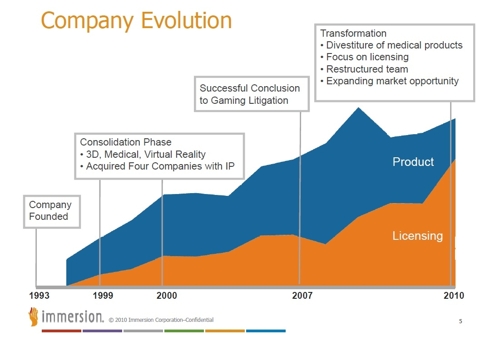

After all, Immersion has been growing since it was founded, although it hasn't been able, so far, to turn its intellectual property (IP) into a profitable Company, something that a licensing model, with 95% margins and growing revenues for improved adaption of haptics, might allow, within a couple of years.

Time to polish off our crystal ball – unfortunately the same that has been wrong so many times in the past about this Company.

Assuming Immersion achieves about $31 Million in revenue for 2010, the portion attributable to royalties, and products sales related to reference and design packages, demo solutions, etc. should be roughly around $ 27 Million.

While we do not believe that Immersion can keep growing royalties at a 75% rate in 2011, we think (hope) that a possible target to achieve in 2011 could be around $ 35 Million, with the increase driven by mobility, with tablets playing an interesting additional revenue stream in the category, chip partnerships, and a full year of medical simulators royalties.

Growth would still be a two digit number, compared to 2010, something Wall Street would appreciate, and such a sustained organic growth would nicely position the Company for 2012, when we hope that additional revenues might mature from other verticals, especially automotive, where just a few model wins could insure good royalties, and from increased royalties per unit in mobility (wider implementation of HD haptics effects).

Here is a quick look at our forecast for revenue (in $ Million):

It's probably useless, at this stage, to try to calculate what this could mean in terms of Adjusted EBITDA or profit in the next few years, as the main question with Immersion is and has always been if the Company can achieve a sustained revenue growth through adding new licensees/verticals, and by getting higher royalties per unit.

Any multiple used in this positive scenario would probably show that there is room for achieving a two digit stock price.

Our capacity to forecast short term action is even worse than our long term modelings. In line with the purpose of the article (let you have fun on our back in the future), we will also add that there seem to be a ceiling on the value of Immersion's stock, at the moment, at about $6.

Ramius, an activist fund that now owns about 13% of the Company, has recently been a seller above this limit, cutting its stake by a few percentage points in the last few months.

With a cost basis of about $4, it makes sense to take a 50% profit, although we believe that there might be another reason for this behavior.

Ramius has recently taken positions in a few turn around stories, like Immersion, mostly to obtain seats in the Board of Directors and push for a sale of the Company.

This hasn't really happened with Immersion, and we speculate that the BoD might prefer to try execute on the existing business plan, in order to maximize long term shareholder value, rather than position the Company for sale.

Assuming our view is correct, time will tell if this behavior does represent another sign that Immersion may be finally close to turning the corner.