Both Equinix (EQIX) and Switch and Data (SDXC) recently reported earnings. Here are the links to the Equinix and Switch and Data P/Rs announcing 4Q and full year 2009 financial and operating results. Equinix 4Q conference call transcripts are available, on Seeking Alpha, at this link.

Previous to that, Switch and Data shareholders approved the acquisition by Equinix, with more than 99% of votes in favor of the merger, and holders of more than 85% of Switch and Data's outstanding common stock participating in the vote. The only remaining obstacle to the combination of the two Companies is now represented by the Department of Justice investigation for anti-trust purposes. The Companies expect the closing of the merger to take place in the 2Q 2010, assuming the DoJ green light will be obtained.

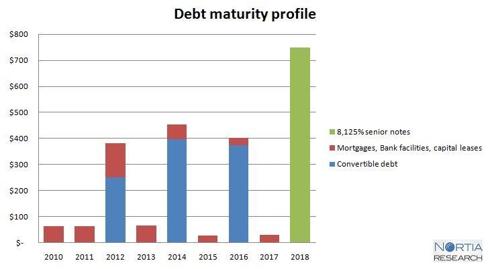

In order to finance the Switch and Data acquisition, including the repayment of the indebtedness that it expects to assume, Equinix announced, on February 22, a $500 million public offering of senior notes due 2018.

Given market response, on February 26 Equinix announced that it had entered into an underwriting agreement to sell $750 million of 8.125% senior unsecured notes due 2018, increasing the original offer of an additional $250 million.

Equinix intends to use the net proceeds from this offering also for general corporate purposes, which may include expansion capital expenditures. As a side note, about $300 million are expected to be needed for the cash portion of the Switch & Data acquisition and repayment of that company's debt at closing. More info about the offering are available in this SEC filing, including the rating on the notes, and we'll add more comments about it later in this article.

A quick look at some highlights from 4Q results, starting with Equinix:

- Equinix reported 2009 annual revenues of $882.5 million, a 25% increase over the previous year;

- 2009 annual adjusted EBITDA was $408.6 million, a 40% increase over 2008;

- The Company issued 2010 annual revenue guidance of $1,050.0 million to $1,075.0 million

Without digging too much into the usual metrics we check for a better understanding of the Company's performance, we'll simply resume that Equinix showed, once more, solid growth, well above Street estimates, and strong performance across all regions. You may check several interesting Equinix non-financial metrics at this link. However, 1Q 2010 outlook was probably slightly below Street expectations (partially due to lower expectations from foreign subs due to the recent stronger US dollar performance), while yearly guidance was basically in line.

A very interesting analysis, after the conference call, came from Michael Rollins (Citigroup):

- "Our study of ongoing capital spending intensity shows the potential for higher capital intensity than long-term guidance, which is dilutive to our valuation analysis.

- "Our bottom-up analysis of capital spending coupled with our analysis of gross PP&E suggests that capital spending for the existing portfolio is likely to stay in a range between 7% and 10% of revenue over time, implying an economic useful life of 20-32 years, versus EQIX guidance of 5% or a useful life of 40 years."

These comments might be worth a specific article, in the meantime, it's worth reporting that Citi's target price, for these reasons, was reduced to $ 106, but remains above the current share price:

- However, we believe returns for the business model remain on a solid footing and we may revisit our thesis if the share price pulls back to the $80-90 range given the support levels implied by our discretionary FCF/share analysis.

Also Switch and Data delivered very good numbers:

- total revenues increased to $205.4 million from $171.5 million for the year ended December 31, 2008, an increase of 20% ;

- adjusted EBITDA increased to $76.3 million from $56.5 million in 2008, an increase of 35%;

- billed cabinets increased from 8,110 in the third quarter 2009 to 8,588 in the fourth quarter. This was the largest sequential growth in billed cabinets in over three years.

It's worth noting that both Companies suffered acquisition related expenses in the 4Q worth a few million dollars.

It is also interesting that, as disclosed on Switch and Data 10-K filing:

- over 50% of new sales in 2009 were in our new or expanded data centers.

As the major expansion made by SDXC was the new data center in the New York metro area, this bodes well as to the results obtained in the financial vertical. Switch and Data ahas also disclosed additional wins in this area, like Chi-X Canada that will, by the end of the second quarter, relocate its primary data centre to Switch and Data’s Front Street facility in Toronto.

A look back at the Equinix conference call, to report some comments that attracted our attention:

- Stephen M. Smith - CEO

- A final note in this region, we’re excited to announce that we have made a decision to enter the Shanghai market through a partnership with a local firm named Shanghai Data Solutions. This agreement will allow Equinix to resell capacity in their datacenter to our multinational customers who have a requirement to have a presence in this market. We’ve selected a great partner to enter this new market and have high confidence that we will be successful executing this opportunity.

Equinix is not new to these kind of deals (with a similar one executed in Thailand a while ago), but the importance of the Chinese market makes this a more interesting opportunity than in the past.

It may be worth spending a little more time examining Equinix debt maturity profile, after the new financing:

Here are a few related comments made during the call:

- Keith D. Taylor

- Turning to our balance sheet and cash flows, at the end of Q4 our unrestricted cash balance totaled $604.4 million, a $23 million decrease over the prior quarter. We continue to benefit from strong operating performance including strong customer collections as our global DSOs decreased to 24 days and lower than expected cash payments related to our capital expenditures.

- Looking forward we’re going to assess our opportunity to refinance our existing debt facilities. Hopefully without using equity or an equity linked structure. Although we have not finalized the next steps we’re going to review each of our debt facilities in Europe, Asia Pacific and the US to determine what is the optimum structure given the opportunity in front of us. As part of this initiative we’ll look to maintain the greatest degree of flexibility while attempting to drive down our weighted average cost of capital on an after tax basis.

Standard and Poor's comments are worth reporting as they resume several interesting aspects of this financing (the rating is available at this link, registration required):

- Standard & Poor's expects that the company will remain aggressive in expanding its data center facilities over the next several years either through organic expansion or acquisitions. Equinix has plans to add capacity in several markets in 2010

- We are lowering the issue rating on the company's proposed unsecured note issue, which was upsized to $750 million from $500 million, to 'B+' from 'BB-' and revising the recovery rating to '3' from '2'.

- We are also affirming the 'B+' corporate credit rating on the company, since the upsized debt issue does not materially change the company's overall credit profile.

- The positive outlook reflects our expectation of continued strong organic growth in data center leasing business demand over the next year.

- "While these activities limit its net free cash flow generating ability over the next few years," added Ms. Cosentino, "they provide the platform for higher longer term cash flow generating ability."

This is a key point of this business model: Equinix is putting a lot of cash on its balance sheet to have the flexibility to continue in its aggressive built out of new facilities (or acquisitions) to grow the business, achieve scale, increase its market share. With the growth of the business, the Company is building a larger "cash cow" for the future.

With the SDXC merger to finalise and the synergies and integration challenges that it will bring, new products being offered and new expansions planned, as Rob Powell commented on his Telecom Rumblings web site:

No comments:

Post a Comment