Accuray (ARAY) will be reporting 4Q 2010 results on Tuesday, August 31st, after the market closes.

Analysts forecast, on average, revenues of $61.15 Million, with a low estimate of $60.10 M. and a high estimate of $62.26 M., and EPS of $0.05 (with a range between $0.03 and $0.06).

During the last conference call, the Company said that it expected revenues to hit the low range of the yearly forecast – see Seeking Alpha's Q3 conference call transcript:

Derek Bertocci - CFO

Due to some delay in one expected shipment, and differences in service products elected by customers, we now anticipate that total revenue will be towards lower end of our guidance range of $220 million to $230 million.

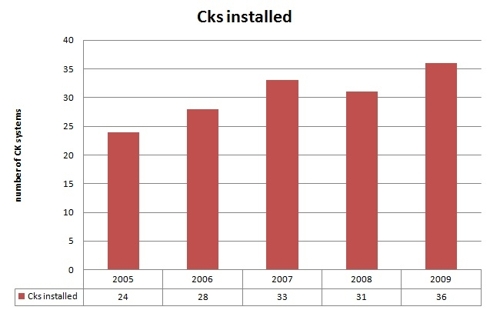

While it is always difficult, due to an accounting change in the way the Company recognizes revenues, to make an apple to apple comparison at Accuray on a quarterly or yearly basis (you may see for reference one of our previous articles), we still believe checking CyberKnife installations is the best way to track Accuray's performance, also to understand if an inflection point has been reached by the company.

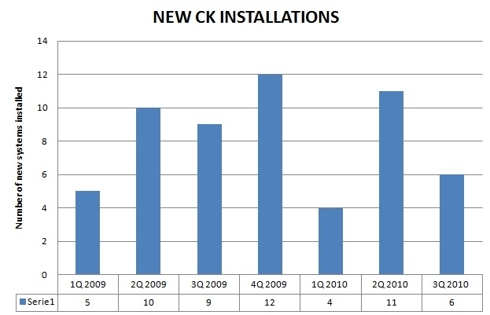

Numbers, unfortunately, are not exciting. As we may see from the following charts, the Company is not even on track to reach last year's installations, unless Q4 comes with very unexpected numbers.

With only 21 installations made in the first three quarters, Accuray doesn't seem capable to accelerate growth, compared to the previous years, even in presence of a good fourth quarter:

Accuray had an installed base of 196 CyberKnife units at the end of Q3:

We installed six CyberKnife systems in the third quarter of the current fiscal year, one in the Americas region and five in the European region. This brings the worldwide CyberKnife's installed base to 196 units at the end of the third quarter, with 125 systems in the Americas, 23 in Asia, 27 in Europe, and 21 in Japan.

A couple of notes related to these numbers.

First of all, Q3 was the only quarter, in the history of Accuray as a listed Company, that saw no new installation in the USA. While we do believe that Accuray will show some installations in Q4 in its domestic region, there's is no doubt that the slow down in its largest market has hit hard the Company.

As reported on the IV Message Board, CyberKnife installations, in the third quarter, were in the following countries:

EUROPE:

(1) Ostrava Cancer Hospital, Ostrava CZECH REPUBLIC

(2) Soest City Hospital, Soest GERMANY

(3) Regional University of Tours, Tours FRANCE

(4) University Hospital of Liege, Liege BELGIUM

(5) Istanbul or Ankara, TURKEY

AMERICAS:

(1) Juravinski Cancer Center, Hamilton CANADA

On June 3rd, Accuray announced the installation of its 200th CK system:

Accuray Incorporated, a global leader in the field of radiosurgery, today announced the installation of the 200th CyberKnife® Robotic Radiosurgery System as continued evidence of its acceptance as the world’s leading device for radiosurgery. The milestone system was installed at Mount Vernon Cancer Centre in the United Kingdom, the first hospital operated by the National Health Service (NHS) in the U.K. to acquire the CyberKnife device.

While the milestone was worth being announced, it would seem to suggest that only 4 systems have been installed in the first two months of Q4, which wouldn't bode well for the total result of the quarter.

We tend to believe that Accuray privileged informing investors about the the first UK NHS installation of Accuray’s CK System, rather than suggesting how installations were doing in the quarter.

Another important milestone was recently achieved when the Company announced that the Japanese Ministry of Health had approved the CyberKnife System to treat tumors anywhere in the body:

Accuray Incorporated (Nasdaq: ARAY), a global leader in the field of radiosurgery, announced today it received Shonin approval from the Japanese Ministry of Health, Labor and Welfare (MHLW) to market the CyberKnife® G4 Robotic Radiosurgery System to treat tumors non-invasively anywhere in the body, inclusive of head and neck. The System will be marketed in Japan as the "CyberKnife® Radiosurgery System".

The CyberKnife G4 System will provide Japanese patients with some of the latest advances in CyberKnife technology including:

Motion management technology to correct for tumor motion including the Xsight® Lung Tracking System, which eliminates the need for fiducials in many lung cases;

Hardware and software enhancements that enable up to 50 percent reduction in treatment time;

Customized treatment plans dictated by clinical requirements and objectives;

Flexibility to adapt the fractionation scheme to meet the unique needs of each patient simply and conveniently in routine clinical practice.

This approval extends the types of Japanese patients that can be treated with CyberKnife to include those with cancers of the spine, lung, liver, pancreas and prostate, in what is expected to be an important strategic market for Accuray.

Turning our attention to institutional activity, Shapiro Capital recently announced that it increased its ownership to almost 15% of the Company, as disclosed in this 13G filing.

For those readers who may be interested in additional diligence about the Company, we suggest to read the recent interview given by Accuray's CEO, Euan Thomson, and available at Medical Device & Diagnostic Industry.

A few quotes about the announced partnership with Siemens, and the stock performance are worth being shared here, as they also address the sales problem we mentioned at the beginning of this article:

On that note, are you pleased with your stock performance?

Overall, we’re not pleased with the stock performance. We’re an undervalued company. And I think many of the issues relate to the type of commercial threat I discussed. What we’re finding investors are looking for, and we’re happily able to deliver, is sales performance. We have an extra level of proof that we have to go to that we can sell against these larger companies. We have a robust technology that is well protected by IP, but you need commercial position. We have done that and we continue to do that.In the last three quarters that I can talk about, we took orders for 41 systems, and we shipped 26 systems. In the context of an installed base of 200 units, to sell 41 in 3 quarters and to have a book-to-bill ratio in excess of 1.6 shows that the CyberKnife is truly a differentiated product in the market and that we as a company have the ability to sell it. When I spent time recently with investors I saw they are definitely starting to gain confidence in the ability of the product to continue to gain rapid acceptance.

How did the Siemens alliance come about?

They’re one of the big capital equipment companies that still have a direct interest in radiation treatment. They produce radiation equipment but the applications of that treatment don’t overlap with those of CyberKnife. They have some expertise that we’re trying to tap into. The relationship helps both parties. We have some very high-level intellectual property and expertise inside Accuray that can help them. And obviously they have a huge brand name and market presence that can help us. It’s a very strategic relationship. As well, they can help us to gain access to customers, and we can help them from a technology standpoint.Does the alliance expand your distribution?

It adds to our distribution capacity. It doesn’t replace the sales team that we already have. I can give you an example that would clarify. For example, there are many cases where an entire hospital may be built or an entire new wing of a hospital cancer center may be built. The customer under those circumstances is often looking for one vendor that can supply all of its equipment. Clearly, they’re not going to come to Accuray with our one very specialized piece of equipment. They’re going to be coming to the big producers, and Siemens is one of those. And now they have the ability to include the CyberKnife as part of their equipment portfolio.In practical terms how else does the alliance benefit Accuray?

We have a good infrastructure for managing the engineering side and equipment. It’s really more about customer access and relationships.

No comments:

Post a Comment